Creating a solid monthly budget is more than just crunching numbers; it’s about plotting a course for financial stability and future gains. Whether you are looking to save for your dream home, retire comfortably, or finance your child’s education, a well-structured budget can help you achieve your financial goals. In today’s investing climate, especially in the vibrant Indian stock market, understanding how to allocate your resources and prioritize investments is crucial. So, how can you create a monthly budget that effectively supports your investment aspirations? Let’s delve into the essential steps you need to take.

Understanding Your Income and Expenses

Tracking Fixed and Variable Expenses

Before you set out to create a monthly budget, it’s vital to have a clear understanding of your monthly income and expenses. Start by listing all your sources of income – salaries, rental income, or any side business revenue. Once you have this figure, it’s time to analyze your expenses.

Fixed Expenses: These are recurring costs that generally do not change from month to month. Examples include rent or mortgage payments, insurance, and subscription services. For instance, if you’re paying a fixed rent of ₹30,000 or an insurance premium of ₹1,500 every month, these expenses should be clearly accounted for in your budget.

Variable Expenses: Unlike fixed costs, variable expenses can fluctuate. These include groceries, entertainment, and discretionary spending. It’s wise to monitor these expenses over a few months to find an average. Suppose you typically spend around ₹10,000 on groceries and ₹5,000 on entertainment monthly; these amounts will provide a guideline for your budget.

Cultural Considerations in Budgeting

In India, budgeting might also be influenced by cultural factors such as festivals and family obligations. For example, you might want to allocate additional funds during the festive season for gifts, celebrations, or even donations. Recognizing these cultural nuances can provide a more realistic accounting of your finances.

Setting Financial Goals for Successful Investing

Aligning Short-Term and Long-Term Goals

Once you understand your income and expenses, the next step is setting clear financial goals. This alignment helps create a budget that not only supports your day-to-day needs but also facilitates effective investment planning.

Short-term Goals: These might include buying a car or saving for a vacation. You can set aside a modest amount each month towards these goals. For example, you may plan to save ₹50,000 over the span of a year for a holiday trip.

Long-term Goals: Retirement planning and home buying are two examples of long-term financial ambitions. Depending on your age and current savings, you might aim to save ₹1-10 crore for retirement, which may require disciplined saving and investing.

Emergency Funds and Investment Opportunities

An emergency fund is essential for unplanned expenses, and ideally, it should cover at least 3-6 months’ worth of living expenses. Use part of your monthly budget to build this reserve. For instance, if your monthly fixed expenses are ₹50,000, aim for an emergency fund between ₹1.5 lakh to ₹3 lakh.

Once your emergency fund is established, you can redirect those savings towards investments. In the Indian context, consider systematic investment plans (SIPs) in mutual funds, which offer a disciplined approach to investing while allowing for market volatility.

Creating an Effective Budget Plan

Applying the 50/30/20 Rule

One of the most popular budgeting strategies is the 50/30/20 rule, a simple yet effective way to manage your finances. According to this rule:

- 50% of your monthly income goes toward needs (housing, groceries, utilities).

- 30% should be allocated to wants (entertainment, eating out).

- 20% is reserved for savings and paying off debt, which includes investment contributions.

For example, if your in-hand monthly income is ₹1 lakh, following this rule means you’ll spend ₹50,000 on needs, ₹30,000 on wants, and ₹20,000 on savings and investments.

A Higher-Saving Approach

If you are particularly keen on saving and investing, especially if you are in your 20s or early 30s, you might benefit from a more aggressive savings approach, such as the 50/50 rule. This strategy allocates:

- 50% of your income for every expense (needs and wants combined).

- 50% directly into savings and investments.

Individuals with high income, minimal debt, and significant financial goals should consider this approach. By focusing on robust savings, you can take advantage of compounding interest when investing in the stock market or mutual funds.

Alternative Budgeting Techniques

While the 50/30/20 rule and the 50/50 rule are valuable, sometimes it’s beneficial to explore other budgeting strategies. Here are a couple of alternatives:

- Zero-Based Budgeting: This approach involves assigning every rupee of your income to a specific purpose, ensuring that your income minus your expenses and savings equals zero. This model forces you to plan thoroughly each month, helping you curtail unnecessary spending.

- Envelope System: Particularly useful for individuals who prefer cash transactions, this technique allocates cash for different categories of expenses into physical envelopes. This prevents overspending since once the envelope is empty, no further spending occurs in that category.

Prioritizing Your Investments

Balancing Financial Commitments with Stocks

Investing can feel overwhelming, especially with fluctuating markets. As you create your budget, determine how you can balance financial commitments with investment opportunities. Remember that investing is a long-term game and should be treated as such.

Consider dividing your investment budget according to your comfort with risk. You might decide to invest ₹10,000 monthly in a mix of stocks and mutual funds, ensuring that your income and recurring expenses are still adequately covered.

Diversifying Your Investment Portfolio

Diversification is crucial for mitigating risk in the stock market. As a new investor, consider allocating funds across a variety of sectors, such as technology, pharmaceuticals, banking and consumer goods. For instance, you may choose to invest in Nifty 50 stocks or equity mutual funds like Axis Bluechip or HDFC Midcap Opportunities, balancing risk and opportunity for growth.

Tracking and Adjusting Your Budget

Utilizing Budgeting Apps and Tools

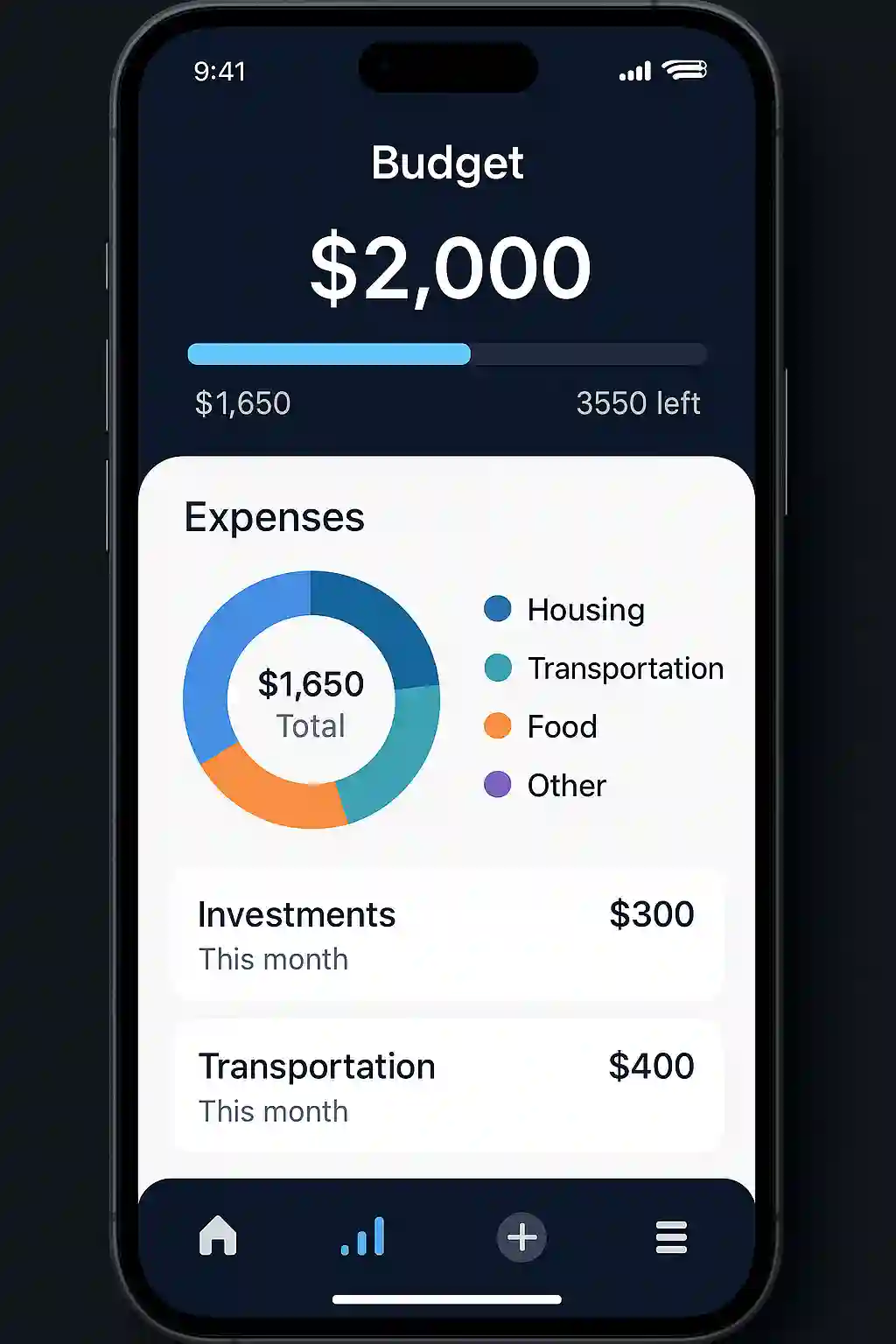

Once your budget is in place, it’s essential to track your spending regularly. Online budgeting tools like “Monefy“ or “YNAB” (You Need A Budget) can help you stay on top of your financial game. These tools allow you to input your spending and monitor how it aligns with your budget.

Investors in the Indian context might also consider using apps from banks or financial institutions that provide expense tracking for investors, making it easier to see where their money is going.

Flexibility and Adaptability in Budgeting

Life is dynamic, and so should your budgeting approach be. Regularly review and adjust your budget based on changes in income or financial goals. If you land a new job that pays significantly more, or if you decide to take on additional expenses, make sure your budget reflects these changes.

Conclusion

Creating a monthly budget that works for investors is an essential step towards achieving financial stability and investment success. By understanding your income and expenses, setting financial goals, and prioritizing your investments, you can cultivate a budgeting strategy that aligns with your personal financial aspirations.

Being adaptable and proactive in tracking your expenses and adjusting your budget ensures that you remain on the right path toward your financial goals.

If you want to continue your education on stock market insights, budgeting techniques, and investment strategies, be sure to subscribe to Stockastic. Our content is designed to equip you with the tools and knowledge you need to succeed in your financial journey!

Frequently Asked Questions (FAQs)

A monthly budget for investors typically includes an understanding of both fixed and variable expenses, income tracking, and careful planning for short-term and long-term financial goals. It should also allocate funds for savings and investments to ensure financial growth.

To track fixed and variable expenses, start by listing all sources of income and categorizing your expenses. Use budgeting tools or apps to monitor these expenses over a few months, allowing you to identify averages and adjust your budget accordingly.

The 50/30/20 rule divides your monthly income into three categories: 50% for needs (housing, groceries), 30% for wants (entertainment), and 20% for savings and investments. This framework provides a balanced approach to managing finances while ensuring you invest in your future.

Young investors might benefit from a higher-saving approach, such as the 50/50 rule, where 50% of income goes toward combining needs and wants. The remaining 50% is dedicated to savings and investments. This method encourages aggressive saving early in one’s financial journey.