Investing in the stock market can seem daunting, especially with countless options available. For many Indians looking to grow wealth steadily without being tied to constant market monitoring, indirect investing through mutual funds (MFs) and exchange-traded funds (ETFs) has become increasingly popular. This article dives deep into understanding mutual funds vs ETFs in India — from definitions and structures to key differences, latest trends, practical examples, and how to pick the right fund for your financial goals.

Basics of Mutual Funds and ETFs

Definition and Structure of Mutual Funds

A mutual fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. It is managed by an Asset Management Company (AMC), with professional fund managers making investment decisions on behalf of the unit holders (investors). Investors buy units representing a portion of the fund’s holdings. The value of these units fluctuates based on the performance of the underlying assets.

For example, SBI Mutual Fund, one of India’s largest AMCs, offers equity, debt, and hybrid mutual fund schemes catering to various risk appetites and goals.

What are ETFs? How do they Trade?

Exchange-Traded Funds (ETFs) are similar to mutual funds in that they pool investors’ money to buy a basket of securities. The key difference is that ETFs trade on stock exchanges like a regular stock and can be bought or sold throughout market hours at market prices. This gives ETFs liquidity and pricing transparency that traditional mutual funds generally lack.

For instance, Nippon India ETF Nifty BeES is a popular ETF tracking the Nifty 50 Index that investors can trade on the NSE just like shares of Reliance Industries.

Active vs Passive Funds

Mutual funds can be actively managed, where fund managers pick securities aiming to beat benchmark returns, or passively managed, such as index funds that replicate benchmark indices to closely mirror their performance at lower costs. In contrast, most ETFs are passive and track indices; however, active ETFs have started to gain traction, offering a hybrid of features.

Types of Funds: Equity, Debt, Hybrid, International

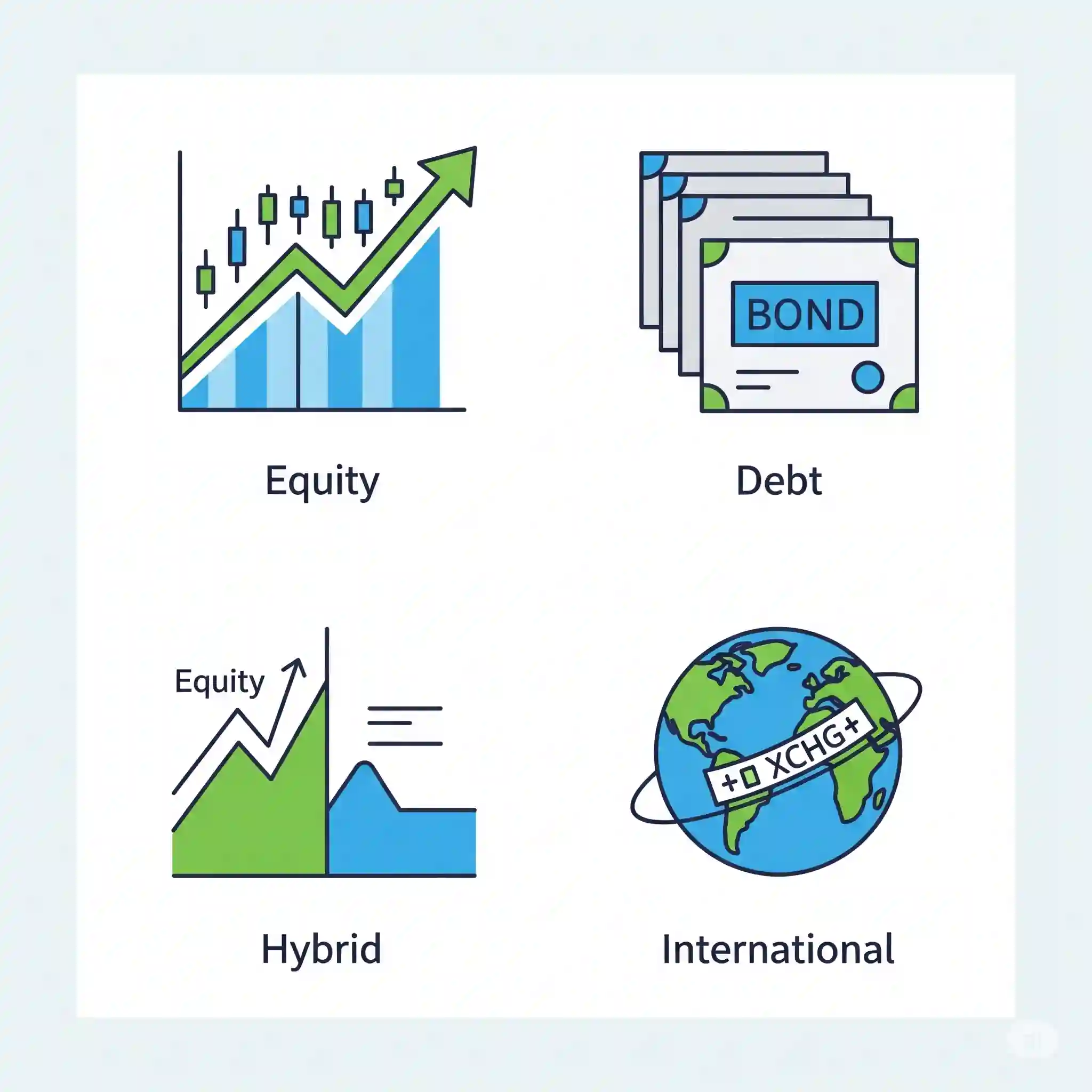

Both mutual funds and ETFs come in different varieties:

- Equity funds invest primarily in stocks, best suited for long-term growth.

- Debt funds focus on bonds and fixed income instruments, offering stability and income.

- Hybrid funds combine equity and debt for balanced risk.

- International funds provide exposure to overseas markets.

Example: Motilal Oswal Nasdaq 100 ETF offers Indian investors access to the US tech-heavy Nasdaq 100 index, expanding diversification beyond domestic markets.

How Do Mutual Funds and ETFs Work?

Investors buy mutual fund units either via direct plans (through AMC websites or apps without intermediaries) or regular plans (through brokers or platforms). Most mutual fund purchases happen via systematic investment plans (SIPs), where fixed amounts are invested monthly, averaging out market volatility.

Mutual funds calculate their Net Asset Value (NAV) at the end of each trading day based on the closing market prices of underlying assets. Investors can buy or redeem units at this day-end NAV price.

Conversely, ETFs trade on exchanges like stocks, with prices fluctuating throughout the day due to supply and demand. Investors need a demat account to trade ETFs, allowing real-time buying and selling.

For example, an investor starting a SIP of Rs 5,000 in the SBI Bluechip Fund commits to monthly investments based on day-end NAV prices. On the other hand, buying 50 units of the Nippon India ETF Nifty BeES happens instantly on the NSE at prevailing market price, with potential price differences from NAV due to intraday market trading dynamics.

Key Differences Between Mutual Funds and ETFs

| Attribute | Mutual Funds | ETFs |

|---|---|---|

| Buying/Selling | Buy/Sell at day-end NAV via AMC or platforms | Trade throughout the day on NSE/BSE like stocks |

| Liquidity | Low – only once per day | High – intra-day trading possible |

| Pricing | NAV-based, updated daily | Market price fluctuates, can trade at premium/discount |

| Expense Ratios | Generally higher for active funds (1%-2%) | Lower, especially for passive index ETFs (~0.05%-0.5%) |

| Brokerage Fees | No brokerage for direct plans; possible commissions on regular plans | Brokerage applicable on each trade |

| Exit Loads | Often charged if redeemed within a specified time | Generally no exit load |

| Management Style | Active and Passive | Mostly Passive; some Active ETFs |

| Tax Treatment | Similar capital gains rules; some nuances apply | Capital gains depend on holding period, STT applicable |

| Minimum Investment | Varies; can start as low as Rs 500 | Price of 1 unit (market price); needs demat |

| Regulation | SEBI regulates with AMFI oversight | SEBI regulates ETFs under mutual fund norms |

Noteworthy Trends, Stocks & Market Events Related to MFs & ETFs in India

The Indian mutual fund and ETF landscape witnessed significant developments in 2023–24:

- Surge in Passive Investing: ETFs and index funds have seen record inflows as investors appreciate low-cost, transparent investment options. For instance, Nippon India Nifty 50 ETF’s assets under management (AUM) crossed Rs 30,000 crore in 2023, reflecting growing popularity. As of 11 Aug 2025, Its AUM is around Rs 49,000 crore

- Rise of Sectoral and Thematic ETFs: ETFs targeting PSUs, ESG themes, and defense sectors have attracted attention. ICICI Prudential PSU ETF saw inflows ahead of the 2024 Lok Sabha Elections, mirroring rallies in companies like Bharat Electronics Limited (BEL) and Hindustan Aeronautics Limited (HAL).

- New Product Launches: India’s first Real Estate Investment Trust (REIT) ETFs and Bharat Bond ETFs have expanded fixed income and alternative asset access for retail investors. International ETFs like Motilal Oswal Nasdaq 100 ETF have become gateways to global diversification.

- Regulatory Initiatives: SEBI’s enhanced disclosure mandates aim to boost transparency on expense ratios, tracking errors, and fund performance, empowering investors to make informed choices.

- Market Events Impact: The 2024 election season created volatility but stimulated fresh inflows into PSU and infrastructure ETFs, showcasing how macro events affect fund dynamics.

Pros and Cons for Indian Investors

Pros:

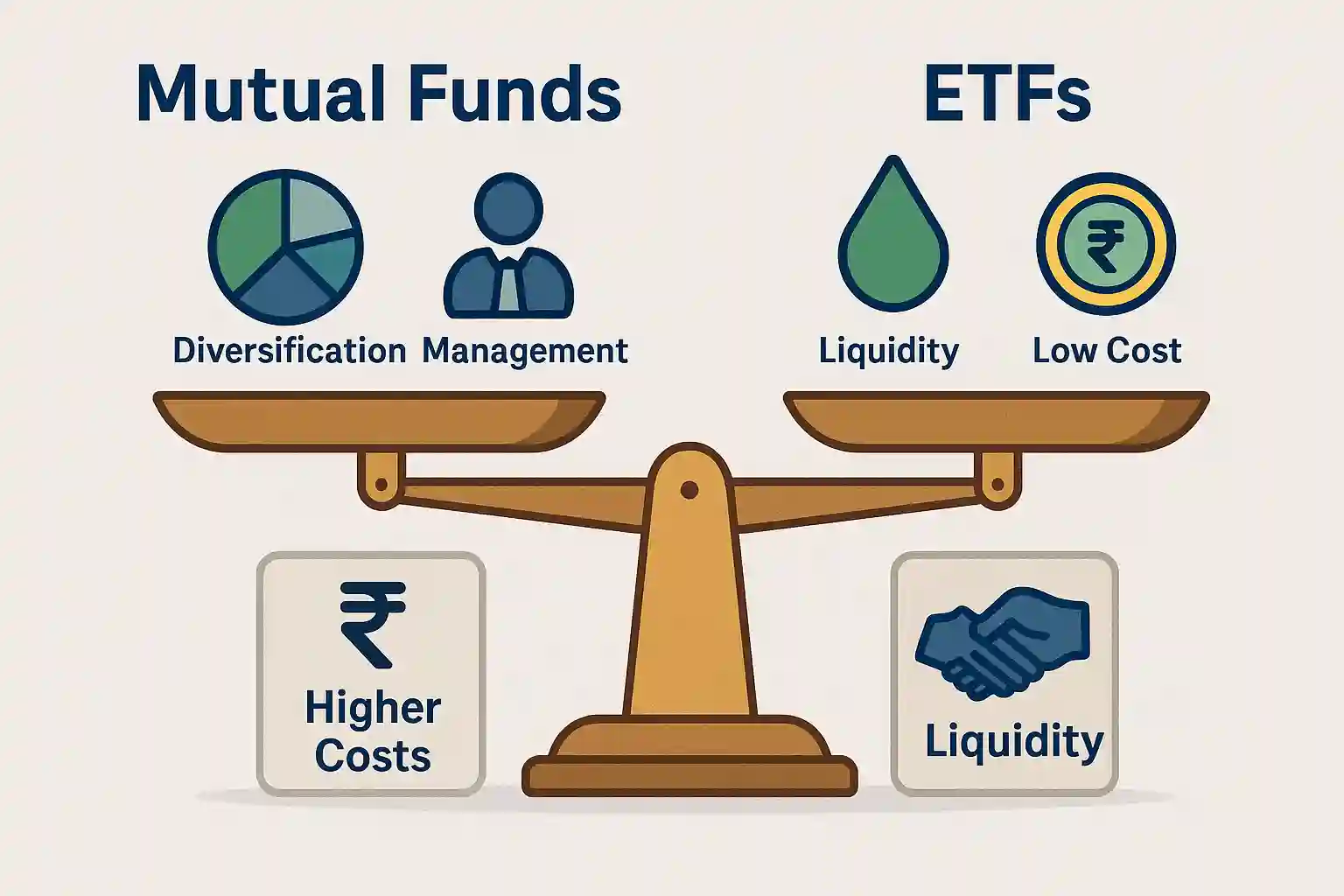

- Mutual funds provide professional management and diversification, making them ideal for beginners and SIP investors seeking steady wealth creation.

- ETFs offer liquidity with the flexibility to trade anytime during market hours at low costs, especially passive ETFs with minimal expense ratios.

- Both options help simplify investing in complex stock markets and reduce single-stock risk.

Cons:

- Mutual funds, especially actively managed, carry higher expense ratios and sometimes exit loads.

- ETFs require a demat account and may suffer from liquidity issues in lesser-traded schemes, leading to price premiums or discounts.

- Tracking error can impact index ETFs if they fail to replicate benchmark returns perfectly.

Real-World Example: Over the past five years, the HDFC Flexicap Fund (active mutual fund) provided an average annual return of around 14%, albeit with higher volatility and expense ratio (~1.8%). The Nippon India Nifty 50 ETF offered steady returns (~12%), lower cost (~0.05%), and easy intra-day liquidity, making it a preferred choice for cost-conscious investors.

How to Select the Right Mutual Fund or ETF

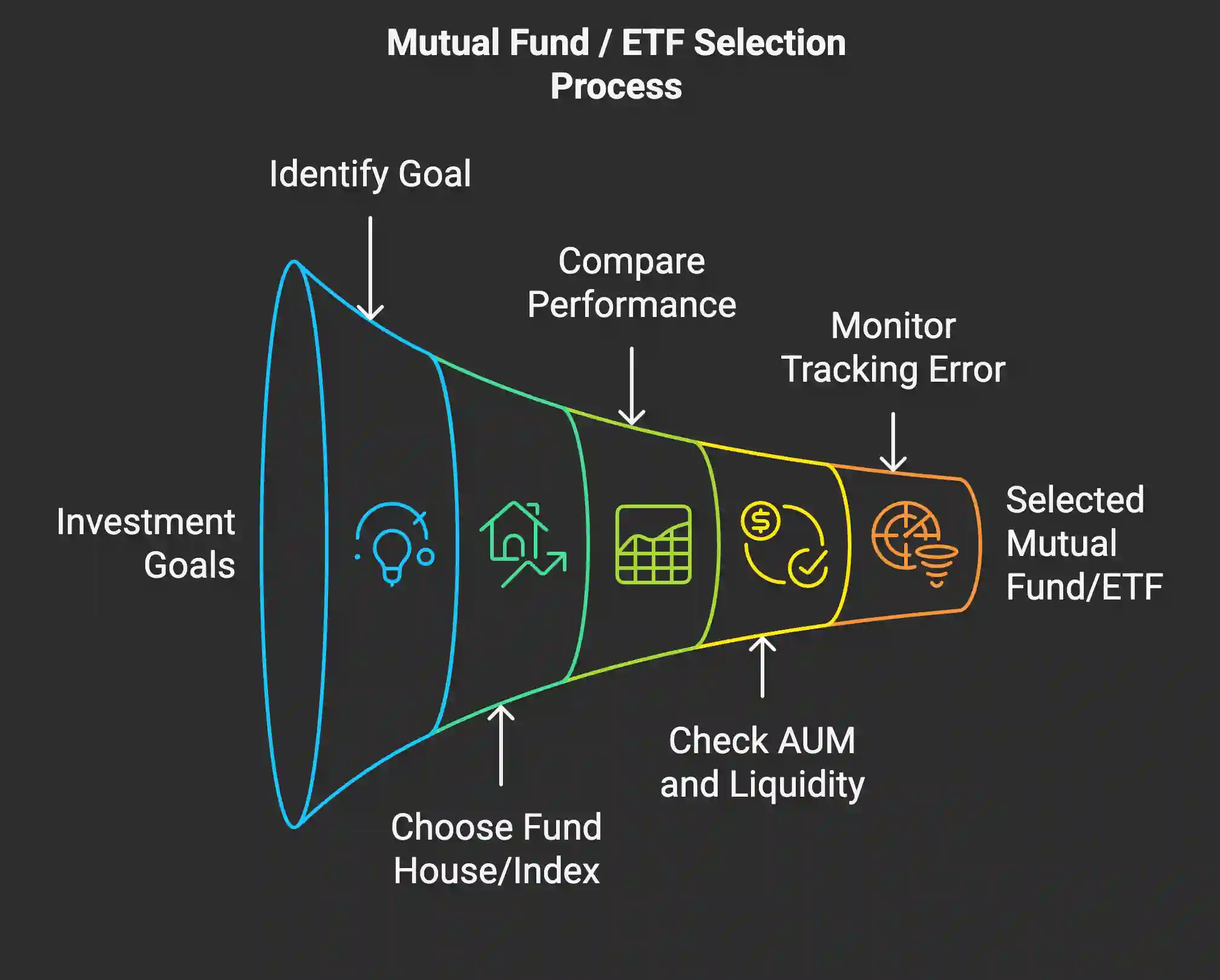

Setting Your Investment Objectives

Identify whether your goal is wealth creation, tax-saving, or global exposure. For example, young professionals may opt for aggressive equity funds or ETFs, while conservative investors might prefer hybrid or debt funds.

Evaluating Mutual Funds: Performance & Costs

- Fund House Reputation: Established AMCs like SBI, HDFC, ICICI are generally more reliable.

- Long-Term Returns: Check 5-year and 10-year returns to gauge consistency.

- Expense Ratio: Lower costs improve net returns; compare with category average.

- Assets Under Management (AUM): Very low AUM schemes may face liquidity issues.

- Fund Manager Track Record: Experienced managers add value.

Evaluating ETFs: Liquidity & Tracking Error

- Look at average daily traded volume and bid-ask spread on NSE/BSE to ensure liquidity.

- Check tracking error, which measures how closely the ETF follows its benchmark.

- Consider the total expense ratio; ETFs typically have low TER but it varies.

Nippon India Nifty 50 ETF is known for low tracking error (~0.02%) and high liquidity, while newer thematic ETFs may have less liquidity and higher costs.

SIP vs Lump Sum Investments

- SIPs help average out market volatility and are suited for mutual funds and ETFs available in SIP mode.

- Lump sum is ideal when market valuations are attractive or for experienced investors timing the market.

You can try the Super CAGR Calculator to project your investment growth.

Red Flags to Watch For

- Very high expense ratios compared to peers

- Star-chasing, or jumping into funds solely based on recent performance spikes

- Very low liquidity or sudden large swings in AUM

- Lack of transparency or frequent manager changes

For more strategic insights, explore Best Long-Term Investment Strategies for 2025.

Taxation and Regulatory Aspects for FY 2025-26

Taxation Rules for Equity and Debt Mutual Funds

- Equity Mutual Funds: Short-Term Capital Gains (STCG) applies if units are sold within 12 months of holding. Tax rate is 20% on gains. Long-term capital gains (LTCG) applies if units are held for more than 12 months. LTCG are taxed at 12.5%, after an exemption Rs 1.25 lakh without indexation.

- Debt Mutual Funds: For investments made on or after 1 April 2023, all gains are taxed at investors’ applicable income tax slab rates. This changed from April 2023, making debt funds slightly less tax-efficient for some investors.

Tax Benefits and Charges for ETFs

- ETFs are treated as equity if they invest minimum 65% in equity. There capital gains taxation is similar to equity MFs.

- Pay Securities Transaction Tax (STT) on ETF trades, similar to stocks.

- Brokerage applies on each transaction.

Conclusion

Mutual funds and ETFs both serve unique investment needs. Mutual funds are well-suited for investors seeking professional active management and SIP convenience. ETFs offer cost-efficient, transparent, and liquid exposure for index and thematic investing. Regularly reviewing your portfolio, understanding risks, and aligning investments to your financial goals are key to success. Start early, stay informed, and consider expert advice when needed. For deeper strategies on financial planning, check out Planning for Retirement: A Beginner’s Guide.

Ready to embark on your investment journey? Subscribe to the Stockastic blog for the latest insights, tools, and expert advice for navigating India’s stock market confidently: Subscribe here.

Yes, many mutual funds allow SIPs starting at Rs 500. ETFs require buying full units, so the minimum investment depends on the ETF’s price.

Not inherently; risk depends on the underlying assets. ETFs have market price fluctuations intraday, given they trade on exchanges.

Low liquidity can result in wider bid-ask spreads and difficulty selling at favorable prices.

Yes, but this involves selling one investment and buying another; consider brokerage, taxation, and timing.