The wave of Initial Public Offerings (IPOs) in India continues unabated. 2024 had notable entries like Hyundai Motors, Swiggy and GoDigit. In 2025 we saw IPOs like HDB Financial, JSW Cement, Bluestone and can expect to see IPOs of Zepto, NSDL and many more. Whether you’re a newcomer or a seasoned retail investor wanting to sharpen your IPO strategy, this comprehensive guide unpacks everything. It will cover various aspects from applying, evaluating, understanding allotments, and making smart post IPO allotment decisions.

Don’t have 10 minutes? Check out the crux in this super simple short in Hindi.

What is an IPO? Are They Popular in India?

An Initial Public Offering (IPO) marks a private company’s first sale of shares to the public, enabling it to raise fresh capital for growth, expansion, or debt reduction. In India, an IPO is not just a fund-raising event but also a branding exercise that provides companies greater market visibility and credibility. The process involves several stages:

- Regulatory approval: Companies submit a draft prospectus to the Securities and Exchange Board of India (SEBI) for vetting.

- Offer period: Once SEBI approves, the IPO opens for subscription, during which investors can apply.

- Listing: Shares are allotted to applicants, and the company lists on stock exchanges like NSE and BSE for trading.

India’s IPO market has seen an unprecedented surge in recent years. Iconic listings such as Zomato and Paytm captured headlines with massive retail participation, while the government’s LIC IPO broke subscription records, drawing in millions of investors. More recently, Tata Technologies’ 2023 IPO was oversubscribed an astonishing 69 times, exemplifying the feverish demand from retail investors. The trend continues into 2025 with names like HDB Financial and Bluestone mobilizing capital in a rapidly growing digital economy. You can check the upcoming IPOs through this NSE link.

How to Apply for an IPO in 2025: Step-by-Step Guide

Pre-application Requirements: Demat, Trading Accounts & KYC

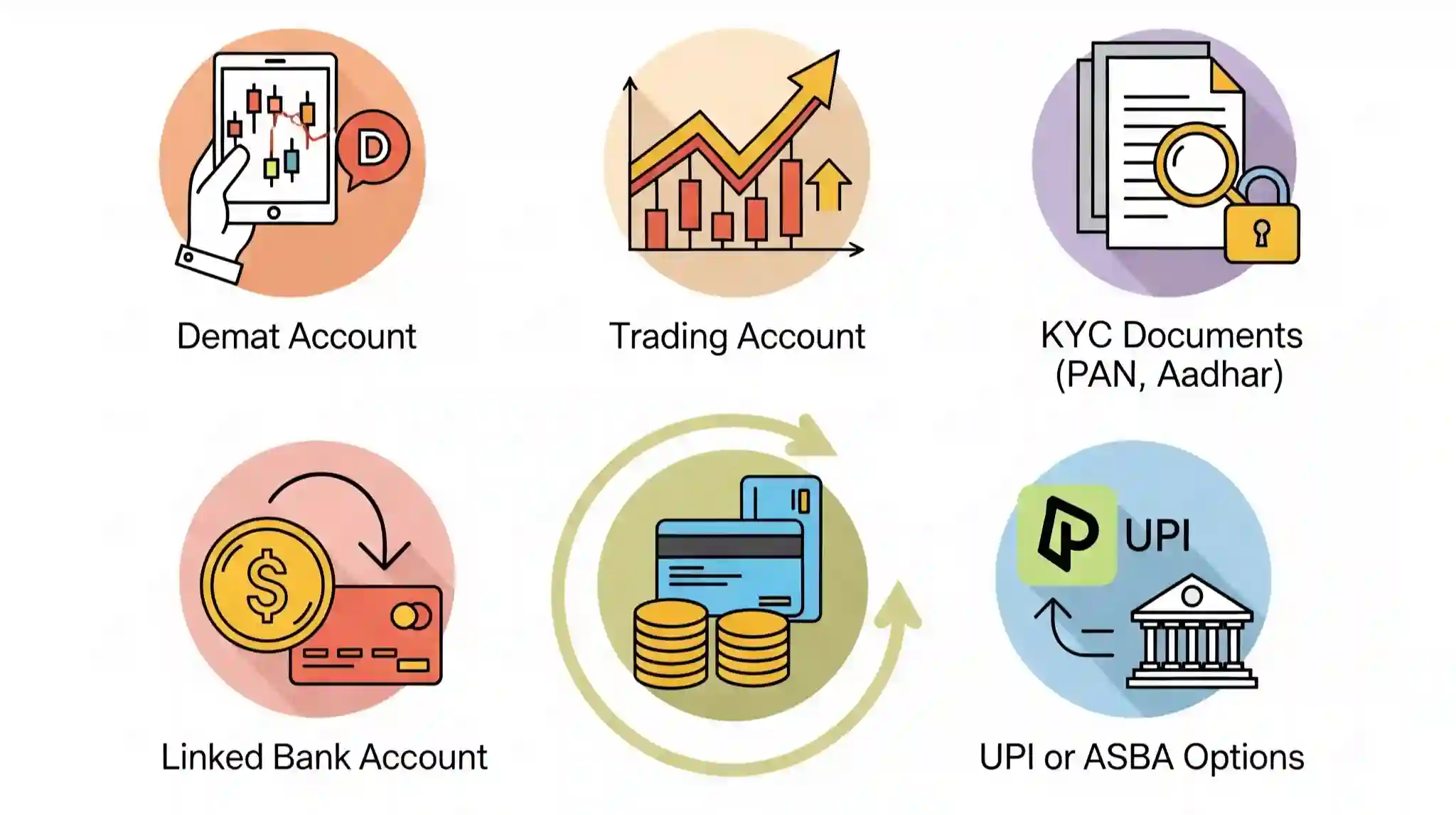

Before you jump into the IPO application process, ensure you have the following essentials in place:

- Demat account: This is mandatory as IPO shares are allotted in electronic form. Opening a Demat account requires identity and address proof, and services are offered by banks or brokerage firms. Charges vary, but zero-balance Demat accounts are increasingly common.

- Trading account: Linked with your Demat, this allows you to buy and sell shares once listed.

- KYC compliance: Ensure your Know Your Customer details are updated; required documentation includes PAN card, Aadhaar, and bank proof.

- Bank account with UPI or ASBA access: Traditionally, IPO payments were made via ASBA (Applications Supported by Blocked Amount) wherein your application amount is blocked, not debited until allotment. Now, most retail investors use UPI-anchored payments like BHIM, Google Pay, or PhonePe for faster processing.

Understanding ASBA and UPI

In 2025, the dominant method to apply for IPOs remains ASBA (Application Supported by Blocked Amount), which temporarily blocks the application money in your bank account until shares are allotted or refunds processed. Integration with UPI (Unified Payments Interface) has streamlined payments, giving applicants flexibility and faster refunds. This method is likely to become the dominant method for IPO applications in the future

Online and Offline Application Procedures

The most convenient route is via your stockbroker’s trading platform or banking app:

- Log in to your trading or netbanking application.

- Select the IPO you want to apply for from the ‘IPO’ or ‘IPO Application’ section.

- Enter the number of shares in multiples of minimum quantity and bid price (market or cut-off).

- Provide the UPI ID if required, and authorize the payment.

- Confirm the application submission and note the application number for tracking.

For example, applying for an IPO using Zerodha’s Kite platform involves navigating to the Bid section, selecting the issue, submitting the UPI mandate, and authorizing payment via the linked app.

Common Application Mistakes to Avoid

- Using incorrect UPI ID or failing to authorize payment timely can lead to application rejection.

- Applying multiple times with the same PAN under different UPI IDs is disallowed and flagged.

- Bidding outside the specified price band can invalidate your application.

- Incomplete KYC or Demat-linked bank account can result in denied allotment.

Typical Application Timelines

The entire IPO application timeline includes:

- Application period (usually 3-5 days)

- Allotment declaration (within 7 days post-close)

- Listing on NSE/BSE (typically 3-5 days after allotment)

Retail and Qualified Institutional Buyers (QIBs) Application Quotas

IPO shares are allotted across quotas:

- Retail Investors (RI): Up to ₹2 lakh per application, enjoy a reserved quota (up to 35%).

- Qualified Institutional Buyers (QIBs) like mutual funds, banks and insurance firms typically get 50% of the quota but can rise to 75% with retail quota reduced accordingly.

- Non-Institutional Investors (NIIs) including High Net-worth Individuals (HNIs) have separate quotas which can typically be around 15%.

If oversubscription occurs in a category, shares are allotted on a proportionate basis, potentially leading to partial allotment.

How to Evaluate Which IPO to Apply For

Investing in an IPO on hype alone can be risky. A disciplined evaluation is key.

Analyzing DRHP and Financials

The Draft Red Herring Prospectus (DRHP) details a company’s business model, financial health, risks, promoter background, and intended use of IPO proceeds. Scrutinize these documents for:

- Revenue trends and profit margins

- Debt levels and cash flows

- Promoter integrity and lock-in periods

- Use of IPO funds: expansion, debt repayment, or promoter exit

For a stepwise fundamental approach to financial analysis, check the Stockastic blog’s Step-by-Step Guide to Analyzing Stocks.

Valuation Metrics: P/E and EPS

Price-to-Earnings (P/E) ratio and Earnings Per Share (EPS) provide quick valuation checks. Compare these metrics with industry peers. Also assess sector growth prospects and government policies. Overpriced IPOs with unrealistic valuations may experience listing-day volatility and correction. Share prices of Tata technologies experienced significant corrections in the months after the listing. I

Understanding Valuation and Pricing Mechanisms

- IPOs specify a price band — a range within which investors can bid.

- The grey market premium (GMP) reflects unofficial pricing sentiment post-IPO announcement but should be treated cautiously. it’s unofficial, volatile, and can mislead retail investors. Use it only as a sentiment gauge, not a sole investment criterion.

- Pricing too high can lead to listing day losses, as Paytm’s 2021 IPO demonstrated, where overvaluation led to weak post-listing price performance.

Identifying Red Flags

Watch out for:

- Chasing hype mentality: Applying based on media frenzy without analysis

- Overexposure: Allocating excessive weight in your portfolio to IPOs, neglecting diversification.

- Ongoing litigations or regulatory probes on the company

- Low promoter holding post-IPO, indicating possible control issues

What to Do After IPO Allotment

Listing Day Strategies: Sell or Hold?

Lists day can bring lucrative gains with high listing premiums, but the choice to sell or hold hinges on your investment horizon and IPO fundamentals.

- Quick flips can be rewarding but there is a risk of missing out on future gains. Evaluate why you invested in the IPO in the first place: Short term profits or long term growth story?

- Holding may benefit long-term investors, especially in fundamentally strong companies like Kaynes Technologies which sustained gains post-listing.

- Evaluate lock-in periods that apply to promoters and anchor investors, as their selling can impact prices.

Checking Shares in Demat Account

Shares are credited usually within 2-3 days post-listing and can be viewed via your Demat account app or netbanking portal. Confirm allotment and holding before planning sell/buy decisions.

IPO Taxation Basics

The taxation of IPOs investment in India is the same as taxation for any listed equity share.

- If you sell within 12 months of allotment, a 20% % Short-Term Capital Gains (STCG) tax is applicable on the gains.

- If you sell after 12 months of allotment, a 12.5% Long-Term Capital Gains (LTCG) tax is applicable on the gains above 1.25 Lakh rupees.

Conclusion

2025 promises exciting IPO opportunities for Indian retail investors, but with opportunities come risks. By approaching IPO investing with thorough research, a clear strategy, and awareness of regulatory updates, you can make informed decisions that balance reward and risk. Remember that each IPO is unique—evaluating fundamentals, understanding allotment nuances, and planning post-listing actions are vital to success. Use the final checklist below before you apply:

- Verify Demat and bank-linked UPI/KYC details.

- Analyze DRHP and financial health.

- Stay within your investment capacity.

- Track allotment status promptly.

- Plan listing day actions aligned to your goals.

For continued insights and expert tips on IPO and stock market investing, subscribe to the Stockastic blog today and stay a step ahead in your investment journey.

An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time to raise capital for growth or debt reduction. In India, IPOs are popular not just for fundraising but also for enhancing a company’s brand visibility and credibility, attracting both retail and institutional investors.

To apply for an IPO, you need a Demat account to hold shares electronically, a linked trading account to buy and sell shares, and updated KYC documents including PAN and Aadhaar. Payments are primarily made via ASBA or UPI-enabled apps that block funds until shares are allotted or refunds processed.

Before investing, review the company’s Draft Red Herring Prospectus (DRHP) for financial health, promoter background, and IPO fund usage. Check valuation metrics like P/E ratio and EPS, compare with industry peers, and be cautious of hype or unrealistic pricing to avoid post-listing losses.