Imagine waking up, placing your first-ever order on popular platforms like Zerodha or Groww, and seeing it execute within seconds! But what really happens behind the scenes in the Indian stock market? For new and aspiring investors, understanding the full journey—from order placement, types of orders, market timings, to settlement and beyond—is crucial. This comprehensive A-Z guide demystifies the entire process in the Indian context, empowering you to trade and invest smarter.

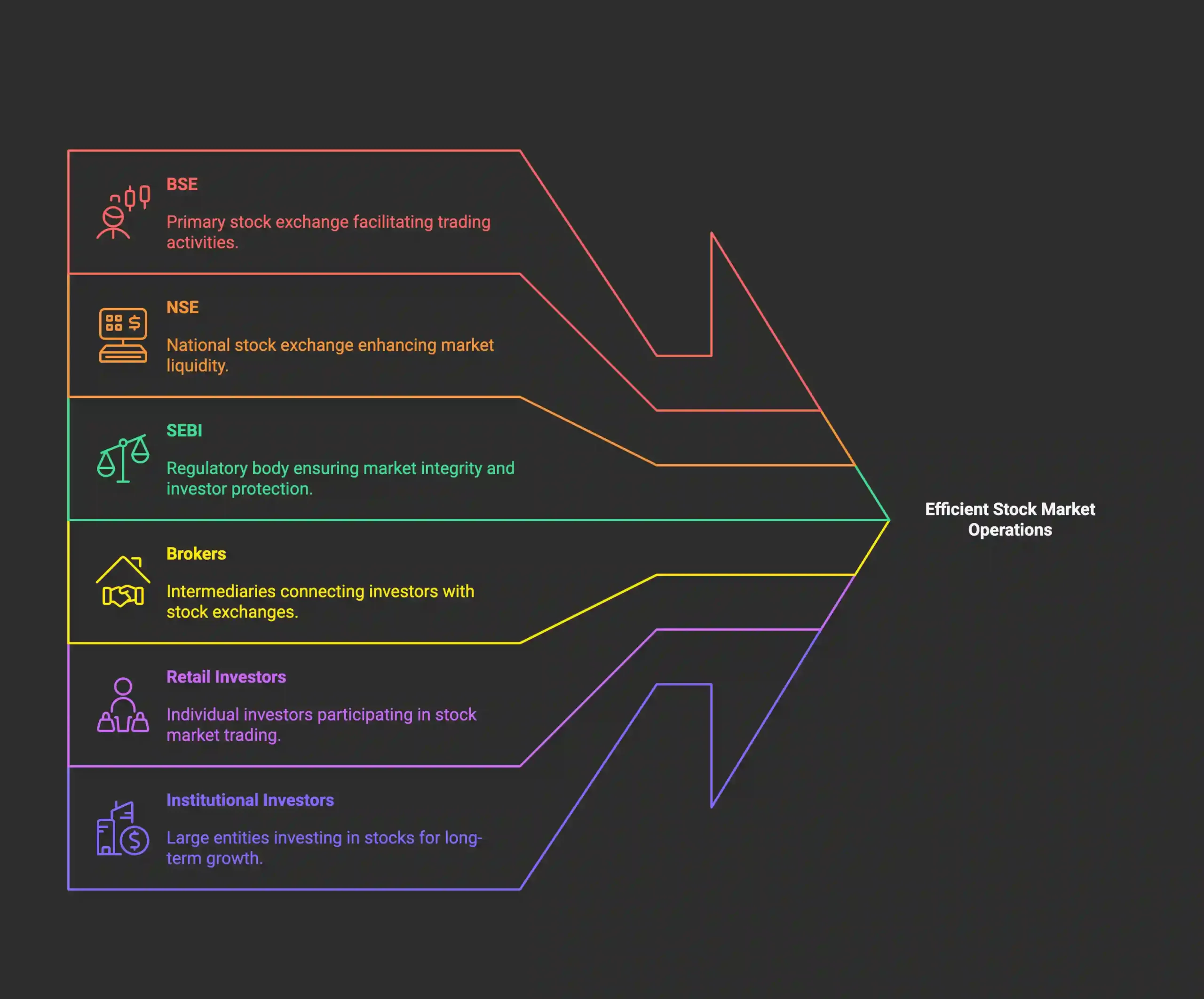

Actors in the Indian Stock Market Ecosystem

Overview of SEBI, NSE, BSE, Brokers, Depositories

The functioning of the Indian stock market relies on a coordinated system of key institutions and intermediaries. At the regulatory helm is SEBI (Securities and Exchange Board of India), which governs market operations, enforces transparency, and protects investors. Two primary stock exchanges — National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) — act as marketplaces where securities are listed and traded.

When you trade, you interact primarily with a stockbroker, such as Zerodha or Angel One, who acts as your agent in placing orders on the exchange. To hold shares in electronic form, you need a Demat account with one of the two main depositories: the National Securities Depository Limited (NSDL) or the Central Depository Services Limited (CDSL). Finally, the clearing corporations like NSE’s NSCCL (National Securities Clearing Corporation Ltd) ensure the smooth clearing and settlement of trades, managing the risk and payment flows between buyers and sellers.

Anatomy of Order Placement in India

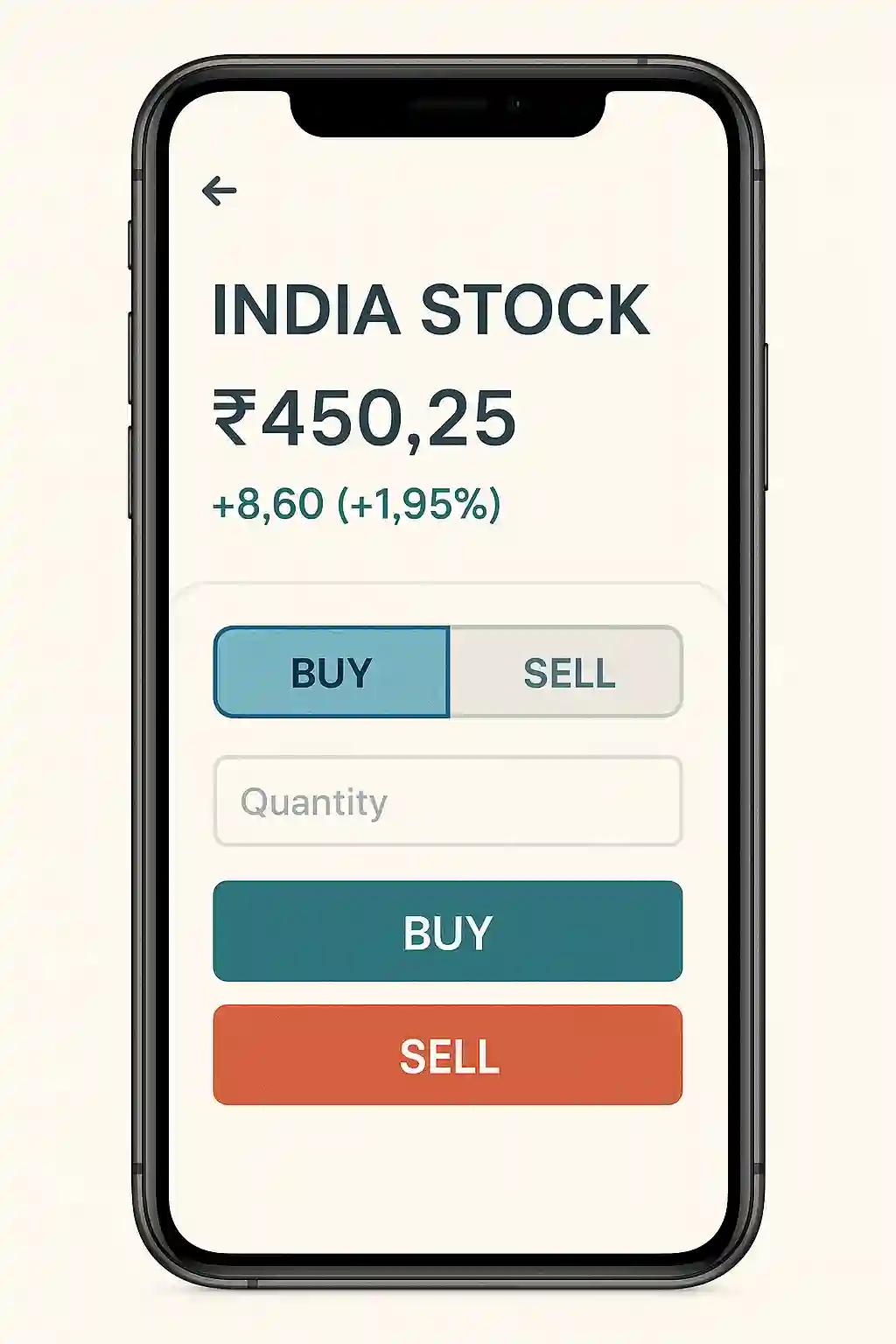

How to Place an Order Using Indian Trading Apps

Placing an order is now as easy as a few taps on your phone. Popular trading apps such as Zerodha Kite, Groww, and Upstox provide intuitive interfaces where you select the stock name (say, Tata Motors), specify the quantity (e.g., 10 shares), and choose your order type. You will also select whether you want to buy or sell. For example, if you want to buy Tata Motors, you enter the stock symbol “TATAMOTORS”, input 10 as the quantity, and select “Buy.”

How Orders Reach the Stock Exchanges

Once you hit “Submit,” your order passes through your broker’s system and is routed to the stock exchange’s electronic order book. The broker verifies you have sufficient funds or shares in your Demat account before sending the order to NSE or BSE. For instance, placing a “BUY: 10 shares of Tata Motors at ₹950” through Zerodha means Zerodha first checks if you have ₹9500 in your account and then your order queues for matching against a seller willing to sell at ₹950 or lower.

Trading Segments: Cash vs Derivatives

The Indian stock market operates primarily in two segments. The Cash (Equity) segment involves actual shares being bought and sold. The Derivatives segment includes futures and options contracts, allowing traders to speculate or hedge without owning the underlying shares. Retail investors starting with direct equity usually start with the cash segment to reduce the risk.

Step-by-Step Example of Order Placement

Suppose you want to buy Infosys shares today. On your trading app:

- Search “INFY” and select Buy.

- Enter quantity, say 5 shares.

- Choose order type — Market or Limit.

- Submit the order.

- Your broker routes it to NSE/BSE if you have sufficient funds.

- Once matched and executed, your app updates order status from “Open” to “Executed.”

- Shares are credited to your Demat account on settlement day.

Types of Stock Market Orders Explained

Market Orders

A market order executes immediately at the best available price. For fast action—such as buying Reliance Industries shares instantly—a market order suits small investors who prioritize execution speed over price control.

Limit Orders

Limit orders specify a maximum buying price or minimum selling price. For example, placing a limit order to buy Zomato shares at ₹255 means your order will only execute if the price reaches ₹255 or less. It protects you from paying more in volatile markets.

Stop Loss Orders

Stop-loss orders trigger automatic sale or purchase upon reaching a set price to limit losses. For example, if Zomato shares drop below ₹220 after negative news, a stop-loss order helps manage downside risk by selling automatically.

Cover, Bracket, and After Market Orders

- Cover Orders & Bracket Orders are advanced options that include built-in stop-loss and target prices allowing better management of profit and risk.

- Cover Orders bundle an order with a stop-loss for risk management.

- Bracket Orders contain entry, target, and stop-loss limits in one trade.

- After Market Orders (AMO) let investors place orders beyond trading hours, common among Non-Resident Indians (NRIs).

Learn more on Basics of Stock Orders: Market, Limit & Stop-Loss for detailed explanations and tips.

Market Timings and Holidays in India

Standard Trading Hours of NSE & BSE

The Indian stock markets operate from 9:15 AM to 3:30 PM IST, Monday to Friday. Before the main session, a Pre-Open Session runs from 9:00 AM to 9:15 AM, letting orders accumulate and setting the opening price through an order-matching algorithm.

Market Holidays 2025 and Their Impact

Upcoming 2025 stock market holidays include Independence Day (15 Aug), Ganesh Chaturthi (27 Aug) and Gandhi Jayanti (2 Oct). On holidays, markets remain closed, affecting order placements and settlements. Missing trading on days when Q4 results of Reliance or TCS drop can delay your settlement cycle and impact your trading strategy.

For official market holidays of 2025, visit NSE India’s website.

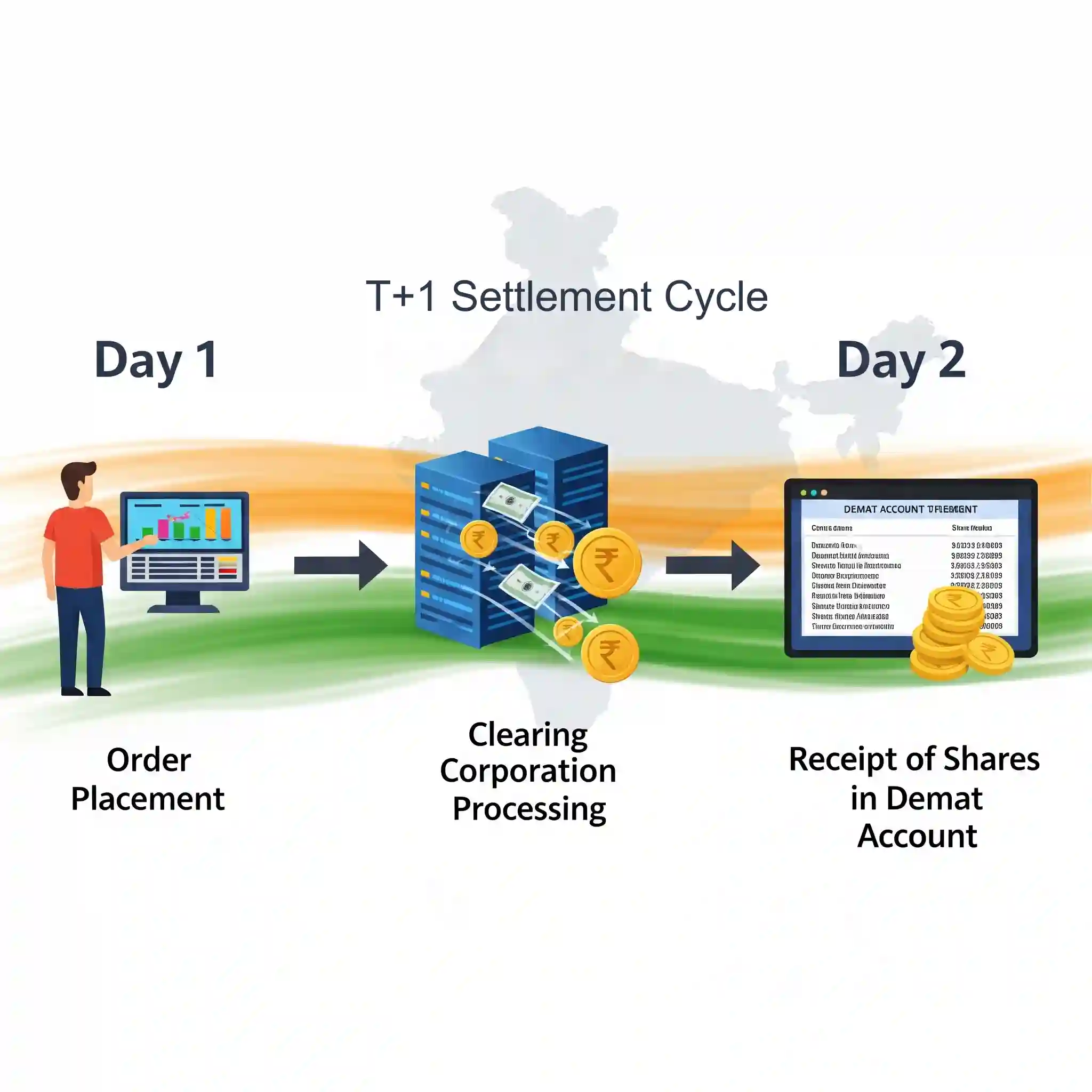

Understanding the Settlement Cycle (T+1)

After trade confirmation, the clearing corporation acts as an intermediary to guarantee settlement. In NSE, NSCCL assumes counterparty risk, managing the orderly transfer of shares and funds. It ensure smooth transfer of funds and securities while reducing risks. Depositories such as NSDL and CDSL maintain your Demat accounts, electronically holding shares you buy.

What is T+1 Settlement?

Settlement means the actual transfer of shares and money between buyer and seller accounts. Since February 2023, Indian equity trades settle on a T+1 basis—trades executed on a day settle the very next day, drastically improving liquidity. Previously settlement was done on a T+2 cycle (trade day plus two working days)

What does this mean practically?

When you Buy

- Day T (Trade Day): You place an order and it gets executed.

- Example: You buy 100 shares of Infosys on Monday.

- The money is blocked in your trading account immediately.

- Day T+1: The shares are credited to your Demat account by evening.

- In the example: You get the shares in your Demat by Tuesday evening.

- Impact: You can sell them only after they’re credited, i.e., from Wednesday (T+2) for delivery-based trades.

When you Sell

- Day T (Trade Day): You place the sell order and it gets executed.

- Example: You sell 100 shares of Infosys on Monday.

- Day T+1: The sale proceeds are credited to your trading account by evening.

- In the example: Funds hit your account on Tuesday evening.

- Impact: You can withdraw the money only after settlement completes (T+1), so fastest withdrawals are now possible the very next day instead of T+2 earlier.

Special Cases

- Intraday Trades: Settlement cycle is irrelevant; profits/losses reflect the same day.

- BTST Trades: You sell the stock before receiving delivery; in T+1 this risk window is shorter, but the risk of short delivery still exists.

- Market Holidays: If T+1 is a holiday, settlement happens on the next working day.

Bottom line for traders in India:

T+1 settlement means faster access to both shares and funds, reducing capital lock-in time. It’s especially useful for active traders and investors managing cash flows, but delivery-based sellers still need to wait until T+1 evening to get funds.

Special Market Events: Trading Halts & Circuit Breakers

What are Circuit Breakers?

Circuit breakers are automatic stops on trading to prevent panic during extreme falls or rises. They can be market-wide, triggered at 10%, 15%, or 20% index moves, or stock-specific, like upper and lower price circuits. For example, Adani group stocks hit lower circuits multiple times after the Hindenburg report in 2023, temporarily freezing trading.

Stock-Specific Trading Halts

Stocks may be halted due to announcements, regulatory issues, or price manipulation suspicions. During halts, orders are frozen, affecting execution and settlement timelines. Frozen or pending orders during halts can lead to confusion or missed opportunities. Retail investors should stay cautious and avoid panic selling on such volatile days. Use limit and stop-loss orders to protect your position. Avoid trading during unexpected news unless you are well-informed.

Latest Digital Trends & Tech Innovations in Indian Trading

UPI-enabled IPOs and e-IPOs

The IPO subscription process has become seamless with UPI-enabled applications allowing instant payments and refunds, enhancing ease for retail investors.

Rise of Discount Brokers and Mobile Apps

Platforms like Zerodha, Groww, and Upstox offer zero or low brokerage, intuitive apps, and educational resources, democratizing access to Indian stock markets.

SEBI’s Digital Reforms

SEBI is constantly updating regulations such as mandatory online KYC, instant account opening, and investor protection measures. For latest circulars, see SEBI Regulatory Updates.

Future Outlook on Trading Technology

Technologies like AI-based advisory, blockchain for settlements, and 24×7 global trading platforms indicate a forward-looking market evolving rapidly.

Common Mistakes & Pro Tips for Beginners

Common Beginner Mistakes to Avoid

- Confusing order types leading to unintended trades.

- Ignoring the T+1 settlement and expecting instant credit of shares or money.

- Overtrading close to market holidays or volatile news.

Important Tips for Smarter Trading

Many investors missed profits in the Tata Technologies IPO or got caught out during sudden circuit breakers due to lack of awareness about order timing and market holidays.

Conclusion and Useful Resources

Understanding how the Indian stock market works—from placing your first trade to navigating settlement cycles and digital innovations—equips you to invest with confidence. The seamless integration of technology and robust regulatory frameworks like SEBI make India’s markets increasingly accessible and transparent for retail investors. Ready to place your first trade? Explore, learn, and invest smarter with the power of information. Subscribe to the Stockastic blog for continuous updates, analysis, and tools that make investing simple and rewarding.

Useful resources for deeper learning include:

- NSE India

- BSE India

- SEBI Official Website

- And our handy Stock Returns Calculator to quickly estimate your investment returns.

The primary stock exchanges in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE is the oldest stock exchange in Asia, established in 1875, while the NSE was launched in 1994 and has become more prominent in terms of trading volume and technological advancements.

There are several types of stock market orders:

Market Orders: Execute immediately at the best available price.

Limit Orders: Execute only at a specified price or better.

Stop-Loss Orders: Trigger an automatic sale or purchase when a set price is hit.

Additional order types like cover, bracket, and after-market orders help manage risk and customize trading strategies.

The T+1 settlement cycle indicates that trades executed on a given day settle the next business day. This improves liquidity in the market, allowing quicker reinvestment of funds, as buyers receive their shares and sellers receive their funds promptly.