Imagine two friends, Aarav and Priya, stepping into the bustling world of the Indian stock market. Aarav believes in buying shares of reputed companies and holding them for years, letting his money grow steadily through compounding. Priya, on the other hand, thrives on the adrenaline rush of quick buys and sells, aiming to capitalize on short-term price movements. Aarav is focussed on investing whereas Priya fancies Trading. Both paths offer their own rewards, challenges, and risks. With over 22 crore active demat accounts reported by NSE in recent years, participation in the Indian stock market is at an all-time high. However, many newcomers find themselves confused about whether to invest or trade, especially amid volatile headlines like US Tariffs or the IndusInd Bank lapses. This guide aims to clarify the difference between investing and trading, exploring their processes, mindsets, risks, and returns with practical examples from India’s dynamic equity markets.

What is Investing?

Long-Term Wealth Creation

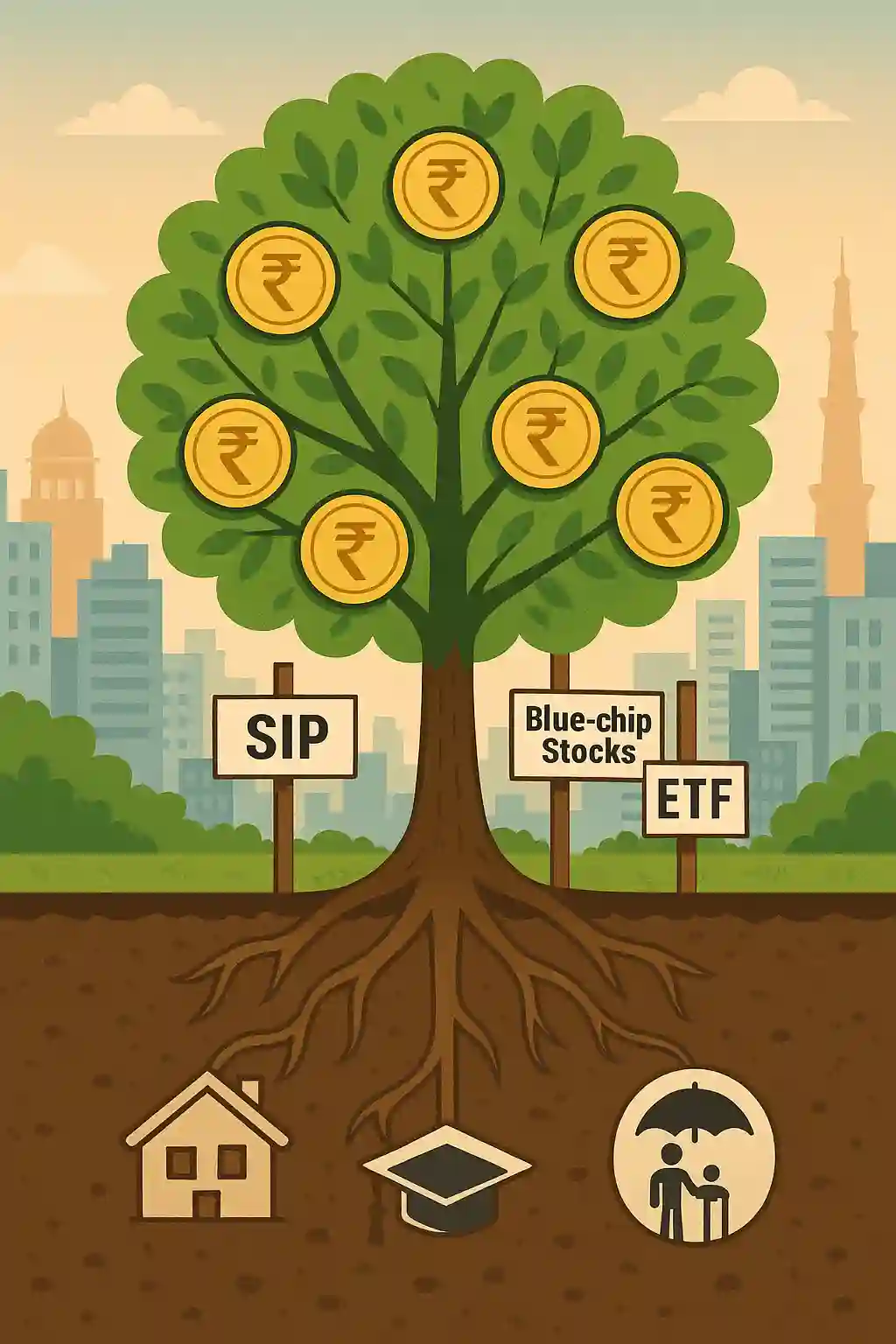

Investing in the Indian stock market primarily means committing your money to quality assets with an eye on growth over several years or even decades. The focus is on creating wealth gradually by harnessing the power of compounding—where your returns earn profits themselves, amplifying growth. For retail investors in India, this approach often forms the foundation of financial goals such as retirement planning, buying a home, or children’s education.

Popular Investment Methods in India

Investors typically choose from several established avenues:

- Systematic Investment Plans (SIPs) in Mutual Funds: A disciplined way of investing a fixed amount regularly in equity mutual funds, helping average out market volatility.

- Direct Equity in Large Blue-chip Stocks: Companies like Reliance Industries, Infosys, and HDFC Bank are favourites among long-term investors due to their proven track records and strong fundamentals.

- Exchange Traded Funds (ETFs): Offering diversification similar to mutual funds but traded on the stock exchange like shares, ETFs tracking indices such as the Nifty 50 have gained popularity for passive investing.

Indian Stock Market Examples

To illustrate, consider Rs. 10,000 invested in Infosys when it debuted in 1993. Over 30 years, that investment would be worth several lakhs, showcasing the power of holding through market cycles. Similarly, Reliance Industries’ share price appreciation over the last two decades has rewarded patient investors significantly due to business expansions into telecommunications and retail. Regular SIPs in a Nifty ETF have delivered approximately 12% CAGR over the past 10 years, steadily building wealth for many.

Long-term investing suits those seeking relatively lower stress and stability, underscoring the importance of fundamentals over market timing. For further insights on planning long-term goals, see Planning for Retirement: A Beginner’s Guide.

What is Trading?

Short-Term Stock Trading Styles

Unlike investing, trading focuses on exploiting short-term price changes in stocks to generate profits. The time horizon here ranges from minutes (in intraday trading) to several days or weeks (swing and positional trading). Indian traders use varied styles including:

- Intraday Trading: Buying and selling shares within the same trading day.

- Swing Trading: Holding positions for a few days to weeks to capture short-term trends.

- Positional Trading: Longer short-term trades, spanning weeks to months.

- Futures & Options (F&O): Leveraged derivatives trading popular on Indian exchanges for hedging and speculation.

For a full understanding, you can refer to Understanding the Types of Traders in the Indian Stock Market.

Technical Analysis and Active Management

Successful trading demands active market monitoring, chart reading, and quick decision-making. Traders rely heavily on technical indicators such as moving averages, volume, and relative strength index (RSI). Several Indian platforms like Stockastic’s Screener provide sophisticated charting and real-time data tools indispensable for traders.

Indian Market Case Examples

Consider HDFC Bank: during earnings announcement days, the stock often sees high volatility which day traders attempt to capitalize on by quick buy-sell trades. Similarly, Zomato’s price swings following its IPO listing in 2021 attracted many traders aiming to profit from price action momentum. The infamous Adani stocks saw massive short-term price gyrations after the Hindenburg report in 2023, presenting both lucrative opportunities and high risk for traders.

Trading is thrilling but involves greater risk, intense focus, and often emotional rollercoasters.

Key Differences Between Investing and Trading

| Aspect | Investing | Trading |

|---|---|---|

| Purpose | Long-term wealth creation | Profit from short-term price volatility |

| Time Horizon | Years to decades | Minutes to weeks |

| Risk/Return Profile | Moderate risk with steady returns | High risk with potential for quick gains or losses |

| Skillset Required | Fundamental analysis (company financials, macro factors) | Technical analysis, chart reading, market timing |

| Frequency of Trades | Low to moderate (buy and hold) | High, often multiple trades within days |

| Tax Treatment | Long-Term Capital Gains (LTCG) taxed at 12.5% above Rs 1.25L (as of 4/08/25) | Short-Term Capital Gains (STCG) taxed at 20%; F&O taxed as business income (as of 4/08/25) |

| Emotional Discipline | Patience and conviction | Quick decision-making, controlling greed & fear |

For example, the same stock like Tata Motors could be a long-term core holding for an investor betting on its turnaround, while a trader might capitalize on sharp daily price movements. Indian investing legend Rakesh Jhunjhunwala exemplified patient investing, whereas trader Rakesh Bansal became known for quick turnaround trades.

Risks and Rewards Comparison

Trading Risks and Rewards

Trading often promises rapid profits, but the risk of substantial losses looms large if markets move unfavorably. Intraday trading requires mastery of volatility and discipline amid market noise. For instance, many retail traders faced heavy losses during the Adani-Hindenburg volatility in 2023 due to high leverage. Similarly, penny stocks in India—though tempting for quick gains—are risky and often attract SEBI warnings due to potential scams.

Investing Risks and Rewards

Investing cushions the impact of short-term volatility by focusing on company fundamentals and long-term growth potential. However, even long-term investments are exposed to market downturns, such as the 2008 global financial crisis or the sharp drops during the 2020 Covid-19 crash. For example, investors in Yes Bank saw steep losses due to issues an governmental bans, whereas short-term traders could have exited earlier to limit damage.

Diversification and Risk Management

Investors often diversify across sectors and instruments to manage risk effectively. Trading also requires strict risk controls like stop-loss orders to prevent runaway losses.

Mindset and Skills Needed

Psychology: Patience vs Agility

Investors need patience, resilience, and conviction to hold through market ups and downs. Traders require agility, quick thinking, and emotional discipline to stay profitable amidst rapid price changes. Panic selling during downturns is a common pitfall for both.

Tools for Investors and Traders

- Investors study annual reports, quarterly results, and company management interviews to inform decisions.

- Traders use chart patterns, moving averages, and volume indicators accessible on platforms like Zerodha Kite and Upstox, often supplementing with news alerts and market sentiment data.

Emotional Discipline Techniques

Keeping emotions in check is vital. Investors benefit from a long-term focus, while traders often track performance metrics to avoid impulsive decisions.

Costs, Taxes, and Practical Considerations in India

Transaction and Brokerage Costs

Both investing and trading incur costs such as brokerage fees (discount brokers like Zerodha and Groww offer low rates), Securities Transaction Tax (STT), GST, and exchange charges. Trading more frequently leads to higher cumulative costs.

Capital Gains and F&O Taxation

Indian tax rules for the 2024-25 assessment year differ distinctly:

- Long-Term Capital Gains (LTCG): Applied to equities held over 1 year, taxed at 12.5% over Rs. 1.25 lakh gains.

- Short-Term Capital Gains (STCG): Applied to equities sold within 1 year, taxed at 20%.

- Futures & Options (F&O): Profits treated as business income, taxed as per individual slab rates, requiring detailed record-keeping.

For example, an intraday trader in Kotak Mahindra Bank shares faces STCG or business income tax, while an investor doing SIPs in SBI Mutual Fund benefits from LTCG taxation.

Hidden costs include slippage (price difference during execution) and taxes also reduce net returns. Use the Stock Returns Calculator to estimate realistic gains of your investments and trades before taxes.

Recent Trends and Notable Indian Market Events (2023-2024)

- Retail participation has surged with record new demat accounts opening, fuelled by fintech apps like Groww, Zerodha, and social media influence.

- The Adani-Hindenburg saga highlighted risks of market manipulation, triggering massive volatility that traders exploited, while investors reevaluated fundamentals.

- IPO price rollercoasters of Zomato and Paytm tested patience and strategy for both investors and traders.

- SEBI intensified crackdown on “pump-and-dump” schemes and introduced stricter rules on leveraged trading.

- Rise of algo trading and social trading platforms cater to tech-savvy young investors aiming to blend investing with active trading strategies.

Choosing the Right Approach for You

Self-Assessment Questions

- What is your risk appetite: conservative, moderate, or aggressive?

- How much time can you dedicate daily to market monitoring and research?

- What are your financial goals: wealth creation, income, speculation?

- How comfortable are you handling market volatility and potential losses?

Combining Investing and Trading

Many experts recommend a split strategy: core investments making up 70-80% of the portfolio for stability, with 20-30% allocated to trading or tactical moves to enhance returns. Indian mutual funds increasingly adopt dynamic trading inside portfolios for alpha generation.

Avoiding Herd Mentality

Beware following hype or celebrity trades blindly, as stories of losses from herding are common in India’s retail segments. Educate yourself through credible sources such as Zerodha’s Varsity courses and SEBI’s Investor Protection Fund.

Conclusion and Next Steps

Understanding the difference between investing and trading is crucial for aligning your stock market approach with personal goals, timecommitment, and risk tolerance. Neither path guarantees success alone; your choice should reflect your profile and financial aspirations. Begin with small capital or virtual trading to build confidence, and meticulously document each trade or investment decision. To explore more insightful stock market strategies, trends, and tools, subscribe to the Stockastic blog and empower your journey in the Indian markets.

Frequently Asked Questions (FAQs)

Investing involves buying stocks or other assets with a long-term horizon, focusing on wealth creation through fundamentals and compounding. Trading, on the other hand, aims to profit from short-term price fluctuations through active buying and selling over days, weeks, or even minutes.

For beginners, investing—particularly through mutual funds or SIPs—is generally safer and easier to understand, as it requires less active management and is less risky compared to trading, which demands technical skills and quick decision-making.

Yes, many investors adopt a hybrid approach—maintaining a long-term core portfolio while allocating a smaller portion for short-term trading to capitalize on market opportunities, aligning with their risk appetite and time availability.