Have you ever wondered what headlines like “Sensex hits record high” truly mean? For many Indians today, the stock market no longer seems like an exclusive playground for wealthy investors or financial experts. From college students and young professionals to small business owners and salaried employees in Tier 2 or Tier 3 cities, millions are now exploring ways to build wealth by investing in stocks. Financial inclusion, digital fintech apps, and growing middle-class aspirations have brought the Indian stock market into everyday conversations.

Understanding the stock market is more important than ever. It can be a powerful tool for wealth creation, retirement planning, and achieving financial goals if approached wisely. Yet, many are held back due to confusion, fear of scams, or insufficient knowledge about how it actually works. This article aims to demystify the fundamentals of the stock market in India, explain the roles played by key players, describe how prices are set, outline recent trends, and guide beginners on how to start investing confidently. By the end, you will be equipped with practical insights that can kickstart your investment journey on a solid footing.

What is the Stock Market?

Stock market vs. share market vs. Dalal Street

At its simplest, the stock market India is a marketplace where shares of publicly listed companies are bought and sold. The terms “stock market” and “share market” are often used interchangeably in India, though technically, “shares” refer to ownership units of a company, while “stocks” is a broader term encompassing shares of any company. “Dalal Street” is the famous address in Mumbai where the Bombay Stock Exchange (BSE) is located, and it has become synonymous with the stock market in India.

Overview of BSE and NSE

India has two major stock exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE, established in 1875, is Asia’s oldest stock exchange and carries immense historical significance. It was on the BSE that the Reliance Industries IPO in the late 1970s paved the way for Indian retail investors to access the stock market in a big way. The NSE, launched in 1992, brought electronic trading and greater transparency, and today, it is the largest stock exchange in India by volume.

Both BSE and NSE provide platforms for trading shares, bonds, derivatives, and other financial instruments. Together, these exchanges form the backbone of the Indian financial market infrastructure.

How Does the Stock Market Work in India?

Role of stock exchanges and order matching

Stock exchanges like BSE and NSE act as intermediaries that facilitate the trading of securities in an orderly manner. When you place an order to buy or sell shares, it enters an order book. The exchanges use sophisticated systems to match buy orders with sell orders based on price and timing, ensuring fair price discovery.

Buying and selling shares: Demat accounts and brokers

Shares are held electronically in what is called a demat account in India. To participate in trading, an investor must first open a demat account with a registered Depository Participant (broker). Popular brokers include Zerodha, Upstox and Groww, which offer user-friendly platforms catering to beginners and seasoned traders alike.

For example, if you want to buy one share of TCS (Tata Consultancy Services) trading on the NSE via Zerodha, you’d:

- Login to your Zerodha trading app or website.

- Search for the stock TCS and add it to your watchlist.

- Place a buy order specifying quantity and price.

- Once matched with a seller, the share is credited to your demat account.

- Your account is debited for the amount, including brokerage and transaction charges.

This process takes seconds in modern trading systems.

Regulatory framework: SEBI and investor protection

The Securities and Exchange Board of India (SEBI) regulates stock market activities to protect investors and ensure fair practices. SEBI has introduced guidelines such as digital KYC (Know Your Customer) for seamless onboarding, and frequently cracks down on manipulative practices such as pump-and-dump schemes. For example, in 2023, SEBI took action against WhatsApp groups spreading fake tips to manipulate small-cap stocks, helping shield retail investors from scams.

Learn more about SEBI regulations at SEBI Investor Education.

Primary vs. secondary markets with examples

The stock market has two segments:

- The primary market where companies raise capital by issuing shares to the public through Initial Public Offerings (IPOs) or Follow-on Public Offers (FPOs).

- The secondary market where investors buy and sell already issued shares among themselves.

For instance, TCS launched its IPO in 2004 to raise funds for business expansion. Post-listing, its shares have been actively traded on the secondary market, allowing investors to buy or sell as per market demand.

Key Participants in the Indian Stock Market

Retail investors vs. institutional investors

Retail investors are individual participants who invest their personal money in stocks. Institutional investors include mutual funds, insurance companies, and pension funds that invest sizable sums. Retail participation in India has surged, with over 22 crore demat accounts active as of April 2025, driven by digital platforms and growing financial literacy.

Foreign Institutional Investors (FIIs) and their impact

FIIs or Foreign Portfolio Investors (FPIs) play a significant role in the Indian stock market by bringing capital and liquidity. Their entry or exit can sway markets dramatically. A recent example is the volatility seen in Adani Group stocks in 2023 following the Hindenburg report. Global investor sentiment influenced Indian indices, underscoring foreign investors’ impact.

Market intermediaries: Brokers, depositories, clearing houses

Brokers facilitate trades between investors and exchanges. Depositories like NSDL and CDSL hold securities in electronic form. Clearing houses ensure transaction settlements proceed smoothly. Leading brokers such as Zerodha and Kotak Securities also provide research tools and trading education for new investors.

Why Do Companies List on the Stock Market?

Raising capital and liquidity

Companies list their shares on stock exchanges primarily to raise funds for expansion, repay debt, or fund research and development. Listing also enhances brand visibility and liquidity, allowing shareholders to buy or sell shares easily.

Examples: Zomato and Paytm IPOs

Zomato’s IPO in 2021 planned to raise ₹9,375 crore to fund growth initiatives and acquisitions. Similarly, Paytm’s 2021 IPO aimed to expand its fintech ecosystem. While both IPOs faced volatile post-listing performance, they gave retail investors a chance to participate in high-growth stories.

How Are Stock Prices Decided?

Price discovery via demand and supply

Stock prices are determined by demand and supply forces. If more investors want to buy a stock than sell it, the price rises; if more want to sell than buy, the price falls.

Impact of news and quarterly results

Prices react quickly to news, quarterly earnings, and macroeconomic events. For example, after Reliance Industries launched Jio in 2016, investor optimism about future growth caused its stock price to surge.

In 2023-24, Tata Motors’ stock experienced upward movement following announcements about new electric vehicle models and promising quarterly results, reflecting the market’s response to positive fundamentals.

Latest Trends and Noteworthy Events in the Indian Stock Market

Boom in retail investor participation since COVID-19

The COVID-19 pandemic saw a sharp rise in retail investors. The work-from home set-up, reduced expenses, increase in disposable income and correction in the stock market due to covid – all acted to boost the retail investors involvement in the stock market. Systematic Investment Plans (SIPs) in equity mutual funds surged, making regular investing more accessible.

Rise of fintech: Apps like Zerodha and Groww

Fintech platforms like Zerodha, Groww, Kotak Securities and Upstox have simplified investing by offering low brokerage, user-friendly mobile apps, and educational resources, thus empowering a new generation of investors.

2024 stock rallies: PSU stocks, auto, pharma, energy

PSU stocks such as Bharat Electronics Limited (BEL) and Hindustan Aeronautics Limited (HAL) outperformed in 2024 due to government reforms and defense spending. In the auto sector, Mahindra experienced significant growth due to surging demand for SUVs. In the pharma sector, Sun Pharma with its innovations, and energy stocks like NTPC showed robust growth.

You can use stock screeners like Stockastic Stock Screener to filter and analyze stocks based on sector, price movements and trading strategies.

Regulatory updates: T+1 settlement, margin rules, SEBI crackdowns

SEBI implemented the T+1 settlement cycle, meaning trades settle within one day instead of two, improving liquidity. Margin rules were tightened to reduce speculative risks. SEBI also cracked down on small-cap excesses, cautioning investors about volatile stocks and fraudulent schemes.

Cautionary tales in small-cap and mid-cap stocks

Many investors chasing quick gains in small-cap stocks faced losses due to pump-and-dump schemes. SEBI’s enhanced surveillance helped restore market integrity in early 2024, but beginners should beware and focus on quality stocks.

How to Start Trading or Investing in India

Opening a demat account and choosing brokers

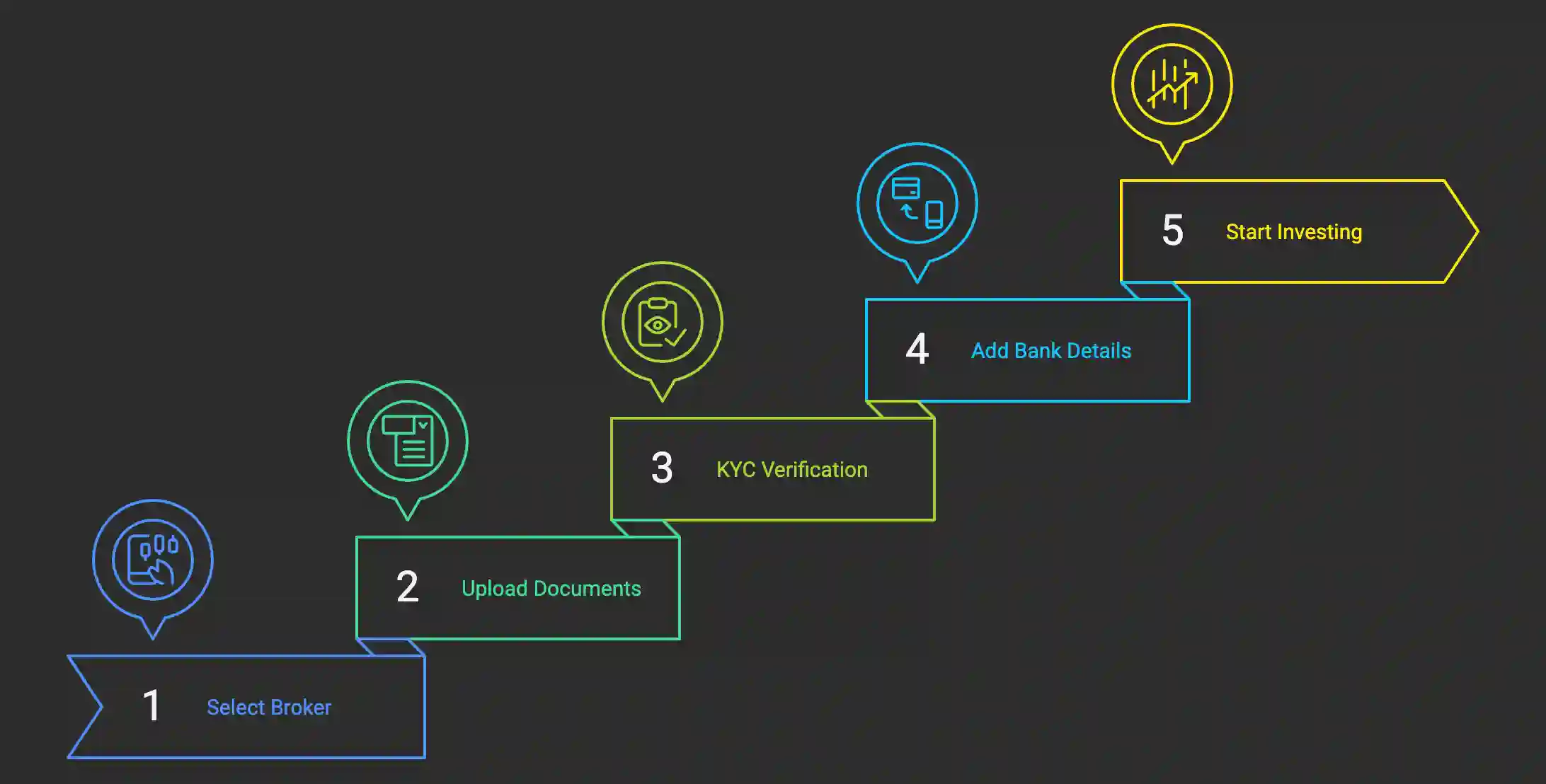

To start, open a demat and trading account with a SEBI-registered broker. KYC formalities can be completed online with Aadhaar and PAN card details nowadays. You can choose one of the popular brokers including Zerodha, Kotak Securities, Upstox and Groww among others.

KYC and fund transfers

Upload your documents, link your bank account, and transfer funds to begin trading. Many platforms offer zero brokerage plans for equity delivery trades, ideal for beginners.

Tips to avoid scams and select SEBI registered intermediaries

Watch out for promises of guaranteed returns. They often come with hidden conditions and traps designed for new investors. Avoid share tips from unverified sources or WhatsApp and Telegram groups.

Example: Using SIP in Nifty 50 ETF for beginners

For a cautious start, a new investor can chose to invest ₹5,000 monthly in a Nifty 50 ETF SIP through their broker’s platform. NIFTY 50 ETF will diversify your exposure to India’s top 50 companies from various sectors. Over 3-5 years, disciplined investing can help new investors build a diversified portfolio with steady returns.

For retirement planning tips, you can read Planning for Retirement: A Beginner’s Guide.

Conclusion & Key Takeaways

The Indian stock market offers unparalleled opportunities for wealth building, provided you understand how it works. From knowing the basics of trading on BSE and NSE to recognizing the roles of SEBI, retail investors, and foreign participants, an informed approach is key. Recent trends prove that retail investors are playing an increasingly important role, supported by fintech innovations and regulatory safeguards.

Start small, stay informed, avoid common pitfalls, and consider long-term investing options such as SIPs in index funds. Your investment journey can be rewarding with the right knowledge and discipline.

Explore your investment journey with awareness—start informed! Subscribe to the Stockastic blog for expert insights and timely updates.

The terms “stock market” and “share market” are often used interchangeably in India, both referring to platforms where shares of listed companies are bought and sold. “Dalal Street” is the iconic location in Mumbai that symbolizes the Indian stock exchange ecosystem, with the Bombay Stock Exchange (BSE) headquartered there.

BSE and NSE provide the electronic platforms where investors place buy and sell orders, which are matched through an order-book system to discover fair prices. They ensure transparent, efficient trading by maintaining regulations and overseeing settlement processes.

A demat account holds your shares electronically, eliminating the need for physical certificates. It is mandatory for trading on Indian stock exchanges, enabling seamless buying, selling, and transfer of securities securely and efficiently.