Introduction

The financial markets act as the lifeblood of an economy, reflecting the intricacies of corporate performance, investor sentiment, and global economic trends. At the heart of these markets lie stock market indices—vital indicators that help investors gauge the performance of shares listed on stock exchanges. Two of the most prominent stock market indices in India are Nifty and Sensex. For retail investors, stock market enthusiasts, and beginners navigating the tumultuous world of investing, understanding the distinction between Nifty and Sensex is crucial. This blog post aims to demystify these two indices, exploring their definitions, methodologies, key stocks, recent trends, and how they serve as barometers for market performance. When considering Sensex vs Nifty, recognizing their individual characteristics is key to better market comprehension.

Understanding Stock Market Indices

A stock market index is essentially a compilation of certain stocks that reflect the overall performance of the underlying market. It provides a way to measure changes in the stock market, indicating how well a specific segment of stocks is performing. The primary purpose of a stock market index is to serve as a benchmark for investors, allowing them to evaluate the performance of their portfolios against a composite of market performance. Both Nifty and Sensex are foundational indices in India, capturing the pulse of the country’s equity market and serving as reference points for individual investors and institutional stakeholders alike.

Nifty

What is Nifty?

Nifty, officially known as the Nifty 50, is the flagship index of the National Stock Exchange (NSE) of India. It comprises the top 50 stocks that are traded on the NSE, representing various sectors and industries that form a substantial part of the Indian economy. Nifty serves as a crucial indicator of the overall market sentiment and is considered a benchmark for investment strategies in stock trading.

Methodology of Selecting Nifty 50 Stocks

The selection of stocks for Nifty 50 is based on specific criteria to ensure its representativeness of the broader market. The index employs a free-float market capitalization methodology, which not only accounts for the company’s market capitalization but also factors in its available shares for trading. Consequently, this method allows investors to gain insights into the actual market performance rather than the theoretical one.

Key Sectors and Industries Represented in Nifty

Nifty 50 spans various sectors, including financial services, information technology, consumer goods, healthcare, and energy. These diverse sectors are crucial in reflecting the economic landscape of India. For instance, tech giants like Infosys and Wipro are significant players in the IT sector represented in the index.

Example of a Popular Stock: Reliance Industries

One of the most notable companies in the Nifty index is Reliance Industries Limited (RIL). RIL is a conglomerate with operations in various sectors, including petrochemicals, refining, oil, telecommunications, and retail. Over the past few years, RIL has demonstrated significant growth due to its foray into the telecom sector with Jio, reshaping the digital landscape in India. Reliance Industries contributes substantially to Nifty’s performance due to its impressive market capitalization and earnings growth.

Recent Trends and Noteworthy Trades in Nifty

As of 2023, Nifty has seen fluctuating patterns due to a mix of domestic and global economic factors. The technological and IT sectors have shown a significant recovery post-pandemic, with stocks like HCL Technologies and Tech Mahindra reaching new highs. Additionally, rising inflation and interest rate concerns have also influenced trading volumes and index movements in recent months.

Sensex

What is Sensex?

The Sensex, short for the Sensitivity Index, is the benchmark index of the Bombay Stock Exchange (BSE). This index consists of 30 of the largest and most actively traded stocks on the BSE. Established in 1986, Sensex serves as one of the oldest stock market indices in India and tracks the performance of blue-chip companies representative of the Indian economy.

History and Evolution of Sensex

The inception of the Sensex can be traced back to a time when even the notion of formal stock market indices was relatively new in India. Over the years, the Sensex has expanded and evolved, currently being calculated using the free-float market capitalization methodology similar to Nifty, although with a smaller base of stocks, thus creating a narrower representation of the market.

Composition of Sensex 30 Stocks

The Sensex includes stocks from various sectors, such as energy, IT, finance, and consumer durables. Some of the notable companies that inhabit the Sensex include Tata Consultancy Services (TCS), HDFC Bank, and ITC Limited. The companies selected for the Sensex are determined based on their liquidity, market capitalization, and widespread recognition.

Example of a Popular Stock: Tata Consultancy Services (TCS)

Tata Consultancy Services (TCS) is a key constituent of the Sensex. Being India’s largest IT services company, TCS plays a vital role in shaping market trends. The company’s impressive growth trajectory reflects its ability to innovate and adapt to market needs. Impressing markets with its consistent performance, TCS has historically influenced Sensex’s movements significantly.

Recent Trends and Trades Influencing Sensex

In 2023, Sensex exhibited volatility, largely influenced by global factors such as inflation rates, geopolitical tensions, and changes in monetary policy. The tech sector, led by stalwarts like TCS, played a critical role in pulling the index in recent months. Significant quarterly results and strategic partnerships have positioned TCS and other Sensex constituents favorably within the market.

Comparative Analysis of Nifty and Sensex

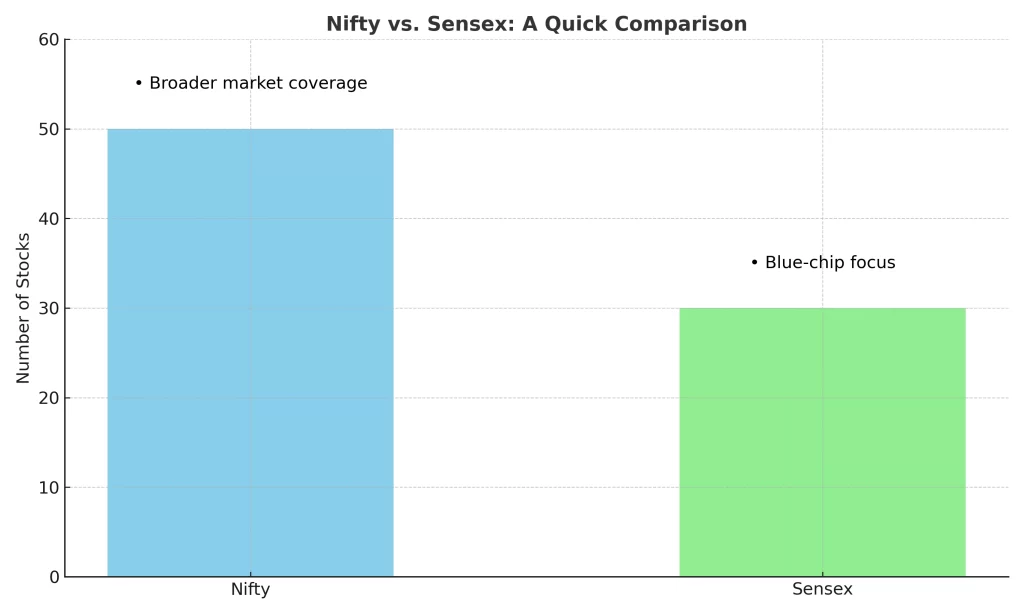

Key Differences in Composition and Calculation

While both Nifty and Sensex serve as leading indicators of market performance, they differ substantially in terms of their composition and calculation. Nifty encompasses 50 stocks, whereas Sensex includes only 30 stocks. Such a difference highlights a level of diversity in Nifty that’s less pronounced in Sensex, making Nifty potentially more reflective of the broad market dynamics.

The index calculation methodology also varies slightly; both utilize the free-float market capitalization approach, but Nifty aims for a broader representation of market sectors compared to Sensex, which leans towards blue-chip firms.

Which Index is a Better Indicator of Market Performance?

Determining which index is a better indicator of market performance often varies based on individual investment priorities. For traders looking for rapid changes and broad sector representation, Nifty might be advantageous due to its larger base of stocks. However, for those focused on blue-chip investments or less volatility, Sensex could be more appealing.

Advantages and Limitations of Each Index

Nifty offers:

- A broader representation of the Indian economy with 50 stocks.

- Greater sector diversity, reflecting sectoral growth patterns.

The challenges with Nifty include:

- Bigger size leading potentially to more fluctuations.

Sensex, on the other hand, boasts:

- A focus on highly established blue-chip companies, reducing extreme volatility.

- Historical significance as one of the oldest indices.

Nonetheless, it may lack in terms of sector coverage as compared to Nifty.

Scenario Analysis for Different Investor Profiles

For long-term investors focused on foundational growth, investing in Sensex stocks could be advantageous. In contrast, active traders and retail investors seeking to capitalize on sector movements may find Nifty more aligned with their strategies.

Conclusion

In summary, both Nifty and Sensex serve as fundamental tools for understanding the movement of the Indian stock market. Their definitions, methodologies, and the nature of stocks they include play critical roles in providing insights into overall market health. By demystifying these indices, investors can make informed decisions tailored to their financial goals and risk appetite. Understanding the nuances of these indices can guide investors in constructing their portfolios effectively while navigating the complex landscape of finance.

Stay informed about the Indian stock market by subscribing to Stockastic! Learn and make informed financial decisions aligned with your strategy.

FAQs

Nifty and Sensex are benchmark stock market indices in India, serving as indicators of the overall performance of the stock markets. Nifty, short for ‘National Fifty,’ represents the top 50 companies listed on the National Stock Exchange (NSE), while Sensex, derived from ‘Sensitive Index,’ comprises the top 30 companies listed on the Bombay Stock Exchange (BSE).

Both indices use the free-float market capitalization-weighted method. This approach considers the market capitalization of each company, adjusted for the number of shares available for public trading, ensuring that companies with larger market values have a more significant impact on the index’s movement.

The base year for Nifty is 1995, with a base index value of 1,000. For Sensex, the base year is 1978-79, and the base index value is 100.