Introduction

The stock market is often perceived as a complex world of numbers and terminology. At its core, it represents a platform where individuals and institutions buy and sell shares of publicly listed companies. It plays an essential role in the economy by providing companies with access to capital in exchange for giving investors a stake in the company’s future growth. In this opinion piece, we will explore the stock market basics. We will delve into its significance, driving mechanisms, recent trends in the Indian stock market, and useful investment strategies. Whether you are a beginner or looking to enhance your understanding of investing in Indian stocks, this comprehensive guide aims to demystify the market and empower you with the knowledge you need to navigate it confidently.

What is the Stock Market?

The stock market serves as a marketplace where ownership of shares can be traded, granting investors the opportunity to own a fraction of a company. It consists of various stock exchanges. These include the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) in India. These exchanges are where stocks of listed companies are bought and sold.

In essence, when a company is listed on an exchange, it issues shares to the public. This allows them to raise capital for expansion or debt repayment. For example, Reliance Industries, one of the largest conglomerates in India, was listed on the BSE in 1977 and has undergone significant transformations since then. As an investor, you can buy a share of Reliance, thereby owning a small piece of the company. You can profit from its successes—whether through capital gains or dividends.

Individual investors participate in the stock market not only to create wealth but also to diversify their investment portfolios. By understanding the nuances of the market, you can make informed decisions that align with your financial goals.

How Does the Stock Market Work?

The Buying and Selling Process

Understanding how the market operates requires you to grasp the buying and selling process. Investors place their trades through brokers—individuals or firms that execute orders on behalf of clients. Trades can be executed on various trading platforms that facilitate these transactions while charging a brokerage fee.

When an investor wishes to buy or sell a stock, they place an order specifying the number of shares and the price they are willing to pay. Market orders execute immediately at the current market price. In contrast, limit orders only execute when the stock reaches the specified price.

Stock Market Indices: Nifty 50 and Sensex

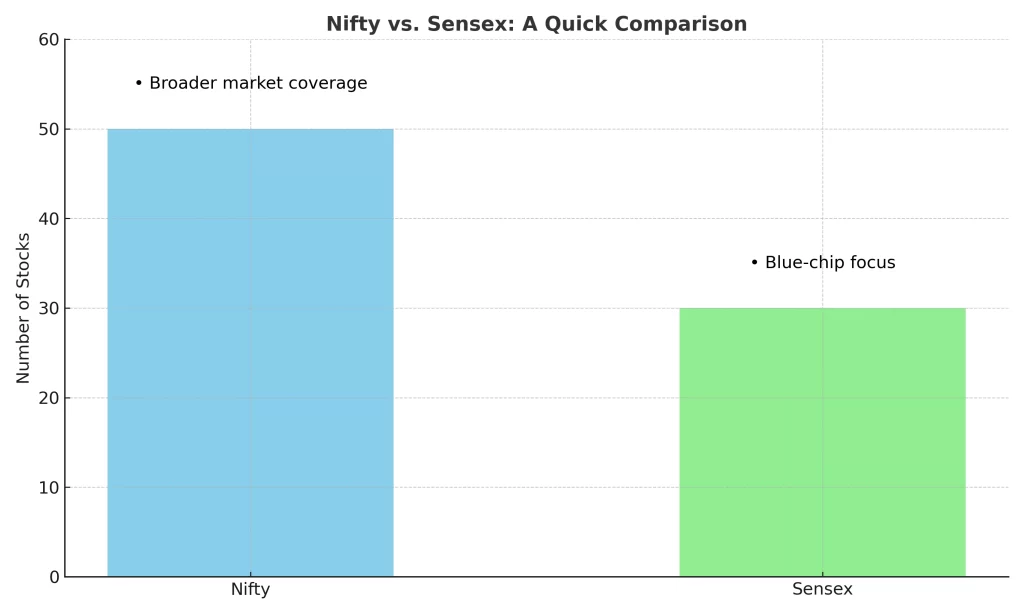

Market indices function as performance barometers for the stock market. Two prime examples in India are the Nifty 50 and Sensex. The Nifty 50 comprises the top 50 stocks listed on the NSE. Meanwhile, Sensex tracks the performance of the top 30 stocks on the BSE. These indices give investors a quick snapshot of market performance and are influenced by the collective movements of their constituent stocks. For instance, a surge or drop in key stocks like HDFC Bank or Tata Consultancy Services (TCS) can significantly impact these indices.

Market Capitalization: Large-Cap, Mid-Cap, and Small-Cap

Market capitalization (market cap) is a vital measure that indicates the total market value of a company’s outstanding shares. It classifies companies into different categories:

- Large-cap stocks (e.g., Reliance Industries, HDFC Bank) typically have a market cap exceeding INR 20,000 crore and provide stable returns over time.

- Mid-cap stocks (e.g., Voltas, CanFin Homes) are valued between INR 5,000 and 20,000 crore, offering a balance of risk and return.

- Small-cap stocks (e.g., Ashiana Housing, Fineotex Chemical) usually valued below INR 5,000 crore can offer high growth potential but are also riskier investments.

Supply and Demand: Price Determination

The fundamental forces of supply and demand primarily determine stock prices. When more investors are eager to buy a stock than sell it, prices rise. Conversely, if more investors wish to sell than buy, prices fall. Taking TCS as an example, if a positive quarterly earnings report triggers increased investor interest, the demand for TCS shares will escalate. This drives the price up.

Conclusion

In conclusion, the stock market is an essential component of our economy, offering opportunities for individuals to invest, grow their wealth, and contribute to the financial health of their communities. Understanding the intricacies of how the stock market functions—including key players, trading processes, and market dynamics—can empower you as an investor. Subscribe to learn more about the Indian stock market.

FAQs

The stock market is a marketplace where individuals and institutions buy and sell shares of publicly listed companies. It enables companies to raise capital and allows investors to own a portion of these companies, potentially benefiting from their growth and profits.

The market operates through exchanges where stocks of listed companies are bought and sold. Investors place orders through brokers, specifying the number of shares and the price. Orders can be market orders, executed immediately at current prices, or limit orders, executed when the stock reaches a specified price.

Indices serve as performance indicators for the market. In India, the Nifty 50 comprises the top 50 stocks listed on the National Stock Exchange (NSE), while the Sensex includes the top 30 stocks on the Bombay Stock Exchange (BSE). They provide a snapshot of market performance and reflect the collective movements of their constituent stocks.